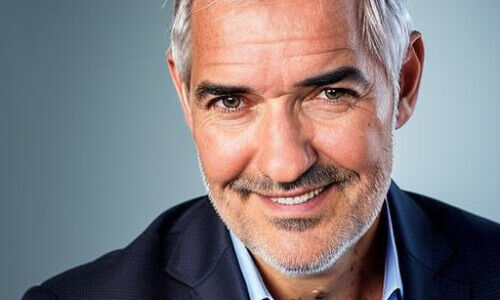

Barend Fruithof, in charge of business in Switzerland at Julius Baer, has plans that will put pressure on his charges to perform and will hire yet more bankers to help him achieve his goals.

Mister Fruithof, sometimes it seems that the majority of staff at Julius Baer used to work for Credit Suisse – just like you.

That's an exaggeration. Of course I know a lot of people from my time at Credit Suisse, including CEO Boris Collardi. But there are also many other highly motivated employees at Julius Baer, who have been doing a great job for years. And it is not like coming home, because I'm not a private banker.

What legitimates you to do the job?

That's a good question! After all, I'm not only head of Switzerland, but also a member of the board. As such I have to contribute with private-banking know how and further areas of expertise.

Hence, it will certainly be of use that I have been a CFO at a bank, been in charge of risk management, operations, corporate banking and institutional business.

You've already managed to convince some of the best private bankers of Credit Suisse to join Julius Baer. Will you poach further people?

We simply need the best people. And that means nurturing the talent we already have at Julius Baer. It wouldn't be a smart strategy to only hire people from CS. We want the best to join Julius Baer.

Where do you think they'll come from?

From the big banks, but also from other private banks. There are numerous talents who've approached us because of the increasingly difficult situation in the industry. I spend 30 percent of my working hours vetting internal and external talents.

How many talents do you need still?

I don't know how smart it is to name numbers. It is not about quantity, but personalities who fit with Julius Baer's culture and are capable of presenting a sensible business plan.

Then you'll have to take a very close look. Julius Baer has a remarkably low market share in Switzerland and your private bankers achieve only moderate profits. Why is Julius Baer performing so meagerly in its home market?

We'll have to put this into the context. It was an honor for me to be approached for this job. The bank was founded in this country more than 125 years ago and Switzerland is still the most important market.

The development of the bank over the past ten years was a real success story. From 2005 to 2015, Julius Baer managed to increase assets under management fivefold. No other bank anywhere manage this – a masterly performance!

Which doesn't answer the question why the bank is doing so badly in its home market.

Julius Baer has a target of generating about half of its profit in emerging markets and the other in the traditional markets. It has achieved that goal.

Ten years ago, this wasn't the case and the dependence on Switzerland and Europe was very high. That's why the focus for future growth was on foreign markets. We also need to keep in mind that the Swiss market is strongly fragmented and that no bank has a truly big share of the market.

Can you explain in more detail?

Customers based in Switzerland are holding about 1,000 billion francs in assets in this country. UBS, the biggest bank, has a market share of about 13 percent in private banking, which surprised me. Credit Suisse has about 10 percent, we have 4 percent, which makes us the No. 3 in the Swiss market.

So you have about 40 billion francs in assets under management in this country?

We don't say officially, because it depends on whether you include accounts at independent wealth managers or not. Suffice to say that we have a market share of 4 percent.

Don't you focus on the super rich clients in Switzerland?

No, Julius Baer takes clients who own one million francs or more, a fact not known well enough in the market. Most people believe you have to invest 10 or 20 million francs. That's wrong. For Julius Baer it matters most what potential the client has with one million francs to start with.

Our client advisers haven't focused enough on this attractive segment in the past. I've told them to get more of them. I will judge my people on this basis.

How big is a portfolio of a private banker today?

It should be somewhere in the region between 150 and 250 million francs. It's part of the pride of a private banker to have a really nice «book».

What is your growth target for Switzerland?

We don't say. You know that we aim to increase net new money 4 to 6 percent annually. The target will be at the lower end of that spread in Switzerland. But that at least I want to achieve and my role is to instill my team with the necessary self confidence.

Is the digital world a danger or does it contain advantages?

With regard to the fintech topic, I see primarily a hype. It will calm down again. I'm convinced that private banking can't simply be replaced by robots.

Are you sure about that?

Customers demanded a much more secure banking system after the financial crisis, because they were concerned about their assets. The same people are now supposed to entrust their money to a robot? That's pretty absurd. I firmly believe that the bank which best combines the human contact with digital processes will be the most successful.

The demands on client advisers will increase substantially because private banks have to offer what no robot can, empathy and personal advice.

How's that?

You advise a customer throughout his entire life: individual wealth, pension and succession planning, with the relevant tax and inheritance questions covered. That's impossible with a robo-adviser.

Don't you meet resistance at Julius Baer with your – at time – rather direct form of communication?

I know that I demand a lot from my team that this is a challenge for some employees. That's part of my job. As a non-private banker I have competences, which enhance the current business. That was probably what Boris Collardi had in mind when he hired me.