Credit Suisse and UBS have had little to report on high-profile legal cases recently. This may be about to change, according to prominent experts – and Credit Suisse is especially vulnerable.

Both big Swiss banks' first quarter was hit by difficult markets and very low client activity. According to bank analysts at Barclays, the old topic of risks linked to settling legal cases remain a «live issue» for the banks to deal with.

Barclays' Jeremy Sigee predicts that by 2018 – incidentally the final year of Chief Executive Tidjane Thiam's three-year plan to double pre-tax profit – Credit Suisse could be forced to raise capital to deal with the issues.

Credit Suisse Cash Call?

The research sent Credit Suisse shares lower on Thursday, weighed by uncertainty over the bank's legal provisions.

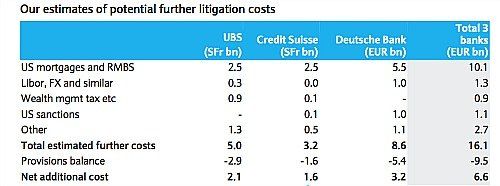

Specifically, Sigee expects the litigation for investment banking for UBS, Credit Suisse and Deutsche Bank will rise considerably in coming years. He expects that efforts to settle a U.S. residential mortgage-backed securities case to cost the Swiss bank $2 billion each.

Barclays expects further legal costs for UBS of 5 billion Swiss francs for fines and penalties (see graph below). At Credit Suisse, Sigee puts the number at 3.2 billion francs of additional costs. Set against existing provisions, the difference begins melting away: UBS faces new legal costs of 2.1 billion francs and Credit Suisse 1.6 billion.

Capital Cushion Key

The equation makes it clear that provisions will be key. Given UBS' solid capitalization and strong revenue generation, that bank's legal risks are «very manageable», according to Barclays' Sigee.

By contrast, Credit Suisse is 5 billion francs short of its capital goal, and its revenue is under pressure at the same time. The bank «has little room to manoeuvre», Sigee says, downgrading Credit Suisse to equalweight and upgrading UBS to overweight as a result.

More Legal Agony

Sigee's conclusion is that with Credit Suisse and Deutsche Bank embarking on a painful restructuring to lessen reliance on more volatile investment banking activities and to bolster steadier asset management and private banking activities, legal costs present an additional – and potentially very costly – complication.

After a hefty writedown at Credit Suisse's investment bank, Thiam used a common German turn of phrase: it is better to make a painful break than to draw out the agony. The pain surrounding legal cases looks to prevail for longer than expected.