Quants vs hedgies, or Credit Suisse against UBS: While Switzerland's No. 2 waxes lyrical about its quantitative asset allocation, the cross-town rival maintains its allegiance to hedge funds.

In financial services, pay is a good measure of performance. The ranking of the best-paid hedge-fund managers compiled by «Institutional Investor» must have made for chilling reading for some: of the top eight earners, six are quants, not hedgies.

Quants is a catchword for an investment strategy based on algorithms and designed to move the markets supported by powerful computers. The computer-based investors are making split-second decisions relatively cheaply and without emotions that cloud the judgement. And: they are good at it.

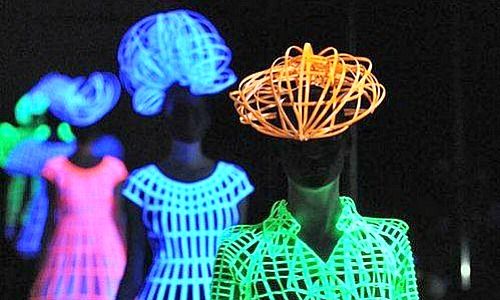

Haute Couture of Wealth Management

While the hedge-fund managers, long celebrated as geniuses and paid accordingly, are stuck in the quagmire, quants are generating profits for their investors. Crisis-ridden Credit Suisse (CS) is now celebrating the success enjoyed by the quants in a note to investors, according to «Business Insider».

The bank feted quants as the new Haute Couture of wealth management. «As Haute Couture, these funds create portfolios from an inventory of tailor-made fabrics or style factors, stitched together with highly calibrated tools,» the bank is cited as saying by «Business Insider». «The 'House of Quant' has firmly established itself as the hedge fund industry's most fashionable strategy due to its high quality product.»

Sought After Investment Strategy

Scores of customers were asking for quants because of their success. The insight of CS is being shared by much of Wall Street. New York's financial heart is beating a little faster than usual as institutes are scrambling to get the best specialists for computer-based investments strategies from the battered hedge-fund companies.

Quants are taking the lead in Switzerland too: Leda Braga, the boss of Geneva-based Systematica, a quants specialist, is convinced that systems are the future, having successfully kept the algorithms working during the financial crisis of 2008.

UBS Is Unconvinced

UBS, Switzerland's No. 1 banking institute, remains unconvinced though. The bank hasn't been shy to promote the use of the investment vehicles and only last week, Mark Haefele, global head of investment at UBS Wealth Management, was quoted as saying that the funds were a good way to diversify a portfolio, despite the less-than-impressive performance since the beginning of the year.