Credit Suisse is displaying signs of a recovery after the first tough months under its new CEO Tidjane Thiam – a positive development and worth more than the mere millions in profit it generated. But there's no place for euphoria, what with a string of problems still to be tackled. Here's a list of the most urgent.

- 1. No Collapse – But No Brilliance Either

One of the surprises of the second-quarter result of Credit Suisse (CS) is that the bank doesn't display the signs of collapse that might have been expected due to the most recent developments under CEO Tidjane Thiam.

But the bank hasn't excelled either. The lukewarm response of the stock market is proof for this. Thiams restructuring and strategy seem to take hold and this is as a signal worth much more than the basic, mediocre figures presented.

- 2. A Profit, But...

The profit of 170 million francs was a surprise. The fact that all units contributed is positive. But CS was profitable not least because of the lower restructuring costs and lower tax rates – not exactly the stuff of dreams.

- 3. Customers Kept Faith

CS has passed the crucial test of net new money development – all three wealth-management units attracted new assets, measuring up to a total of 11.3 billion francs. Margins increased. Assets under management rose to 1.218 billion francs by the end of June from 1.181 billion three months earlier.

- 4. CS Is Shrinking – Too Quickly

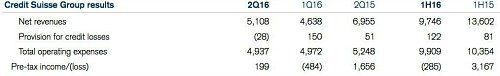

The massive decline in revenue in the first half of this year is remarkable: earnings declined 28 percent, or by a whopping 3.8 billion, compared with the six months in 2015. The reduction in costs didn't quite keep pace. Thiam managed to reduce costs by 4 percent, or 445 million francs, over the course of a year.

The disproportionate development of earnings and costs is manifesting itself at Global Markets, the investment banking unit. Thiam has to address this.

- 5. Capital Requirement – Under Control

The increase of the core capital ratio to 11.8 percent from 11.4 percent at the end of March is mainly due to the reduction of risk-weighed actives by 9 billion francs. CS thus is on course to meet its target range of 11 to 12 percent by the end of 2016.

The leverage ratio was stable at 3.3 percent, a figure much looked at by regulators. A stronger capital base and further reduction of risks thus remains crucial.

- 6. Swiss Going Strong

The Swiss Universal Bank (SUB), under the guidance of Thomas Gottstein, has not been able to escape the decline in revenue, but remains the strongest contributor to profit with the group. Pretax of 453 million francs is the best by a distance and exceeded analysts' expectations. This is most important for Thiam's plan to sell a stake in the unit in an initial public offering next year to bolster the capital base of the bank.

- 7. Investment Bank – a Question Mark

Global Markets at the investment bank is Thiam's biggest headache. A decline in earnings of 29 percent is proof of the cleaning-up process taking place at the unit.

The bank is reducing risky investments, moving them into the bad bank to allow capital be put to work more efficiently. But cost cuts aren't keeping up with the shrinking of business. However, the unit, which was in open revolt against the CEO, remains active enough and boosted earnings by a third in the second quarter from the first.

Investment Banking and Capital Markets (IBCM), the consulting business, also displayed rays of hope. CS said it had gained market share in the second quarter.

- 8. International Wealth Management – Turnaround

International Wealth Management (IWM) in previous quarters had seen assets leaking. Iqbal Khan has achieved a turnaround – the unit generated new assets of 5.4 billion francs. That's the base for future earnings. Thiam's ambitious target for 2018: a pretax of 2.1 billion francs. With six-month pretax of 545 million this year, there's some ground to cover still.

- 9. Asia: The Price of Growth

Asia managed to get 5 billion francs from wealth clients in the second quarter, up from 700 million in the first. The price for the growth was an increase of relationship managers by 100 to 650 within a year. The cost-income ratio dropped by 10 percentage points to 72.7 percent as a consequence. In other words: profitability has to rise.

- 10. Thiam Can't Escape Spiraling Personnel Costs

The cost-cutting program is shaping up, but the war against high wages and bonuses isn't over. They increased by 10 percent in the second quarter – while the number of staff declined slightly. Lock- and retention premiums for top staff caused the surge in costs.