Varia, a Swiss real estate company, plans to go public to raise money to widen its portfolio. It has also engaged prominent support with a past at UBS to help it achieve its strategic goals.

Varia US Properties, a Swiss real estate company based in Zug, is planning its initial public offering (IPO) on SIX stock exchange for the coming months. It will use the money raised to buy further properties and to reduce debt, Varia said in a statement today.

The company will be the second within few months to announce its IPO, following Investis. Varia is a little special in the way it operates: having been founded a year ago only, the company invests exclusively in U.S. residential real estate, including in property occupied by poorer families, profiting from the low income housing tax credit.

Cooperation With Stoneweg

Varia, a small company by comparison with a portfolio of $301 million and an annual profit of $4.5 million, has a cooperation agreement with Stoneweg, a Geneva-based real estate company invested in the Spanish market. Stoneweg is supporting Varia in the portfolio management and with the implementation of its investment strategy.

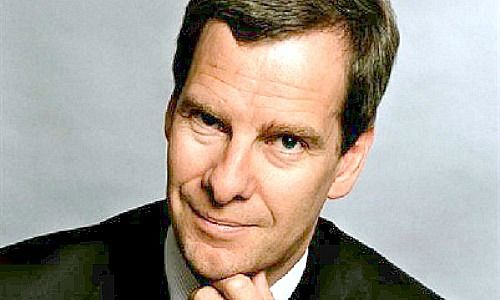

The company also has been able to attract some experienced managers for its board of directors. Varia proposes Beat Schwab (pictured above), head of real estate investment management at Credit Suisse, and Patrick Richard (pictured below), chairman of real estate funds company Procimmo and head of U.S. investments at Stoneweg, for election at the annual general meeting of November 14.

Prominent Backers

Varia also managed to convince Manuel Leuthold to take a seat on its board and will propose him for election too. Leuthold is the former head of corporate banking at UBS Switzerland.

Leuthold also holds a seat on the Swiss Federal Social Security Funds, the central manager of the assets of the Swiss government-administered social security institutions. He also sits on the board of Banque Cramer and real estate investor Fundim.