The rich people of this world are on the move – thousands are leaving Paris and Rome despite the beauty of these cities, a study shows. The trend to move to other places doesn’t make life easier for Swiss private bankers.

It isn’t only the poor and oppressed who move to other countries. The super-rich are migrating too, according to the «Wealth Report» published by Knight Frank, the U.K.-based real estate consultancy.

Multi-millionaires are concerned about global instability and in recent months have moved more assets across the world than before – or indeed relocated themselves. Visa opportunities for rich investors are sought after, the study shows, and the trend is likely to continue throughout this year.

European and Americans

Ironically, the seriously rich tend to move in the opposite direction of refugees. It is the top one percent in Europe and the U.S. which is the most eager to emigrate.

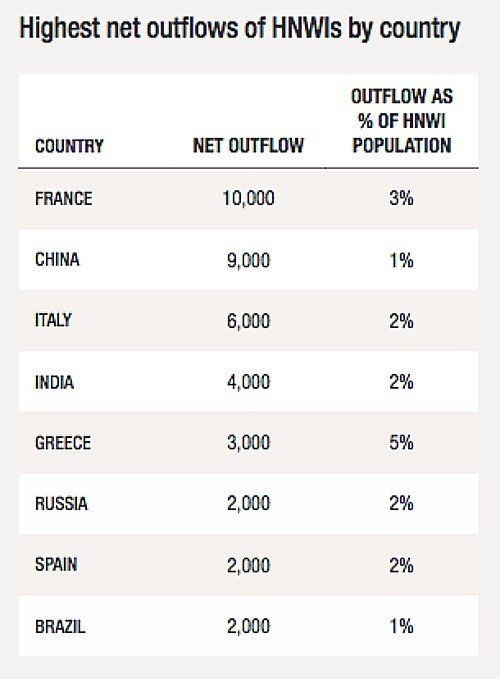

Some 10,000 millionaires (HNWI) have left France over the past twelve months alone (see table below). The country is facing presidential elections with the worrying prospect of a right-wing extremist grouping taking power in one of the biggest countries in Europe. A victory for Marine Le Pen has the potential to upset the foreign currency with the euro coming likely under pressure.

London Has Net Inflow

Italy and Spain are equally facing a drain of very rich citizens, while the U.K. doesn’t make the top rankings despite its decision to leave the European Union. In fact, London attracted a net 500 rich people last year, while Paris lost 7,000 and Rome 5,000.

Millionaires in China, Russia, India and Brazil are also eager to leave, making clear that assets aren't easily to be found in emerging markets either.

Attractive Australia

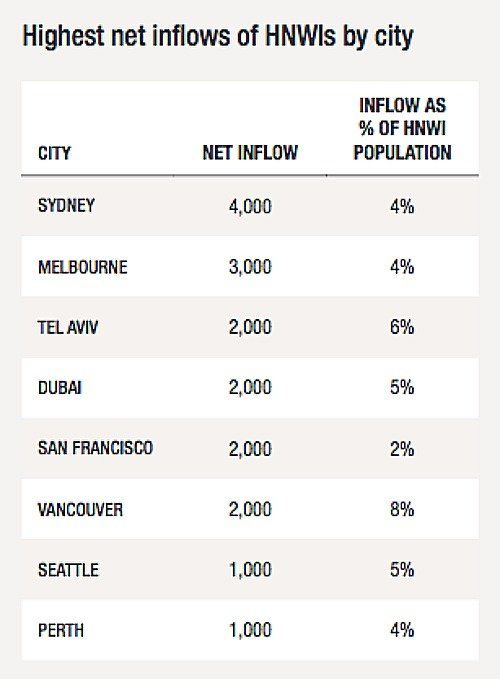

There are however places where Swiss private banks might find rich investors. The two big Australian cities of Sydney and Melbourne, Tel Aviv and Dubai are four of the places with strong inward moves of rich people (see table below).

San Francisco and Seattle on the U.S. West coast also seem popular with the wealthy, despite the fact that the U.S. rich display signs of considering emigration.

Controlling Governments

The migration of rich is gathering pace while it gets more difficult to move assets around the globe. China has introduced capital transaction controls, Russia attempts to investigate the tax schemes applied by its oligarchs and even countries such as Brazil and Indonesia are trying to curb tax avoidance.

There are about $10,000 billion held offshore. But the inflows may dwindle to a mere trickle. Singapore for instance may yet see the first net outflow this year.

Switzerland meanwhile, still the biggest offshore center for asset management, has come under intense scrutiny by countries eager to recoup some money belonging to their citizens to raise more taxes.

Keeping Tap on Citizens

They also want to make sure that no undeclared assets are leaving Switzerland to smaller offshore places. With the newly introduced automatic exchange of information, they have gained an instrument to keep check of their nationals.

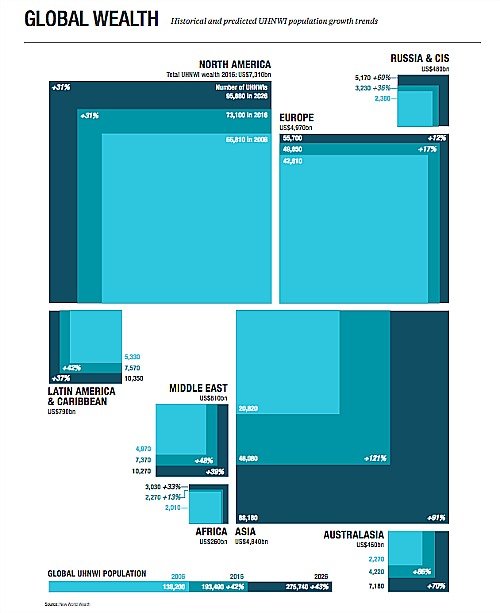

Swiss private banks are having a tougher time than before, because the migration of millionaires is changing the distribution of wealth across the globe (see table below). In other words, Swiss bankers need to carefully evaluate where they want to be to present to offer their services.

Staying put, sitting on the coffers full of cash won’t be an option – that’s for sure.