Liechtenstein's princely LGT bank has taken a quantum leap with the acquisition ABN Amro's Asian arm. LGT Asia boss Henri Leimer tells finews.com why his clients don't actually care for the luxury on display at many private banks in the region.

Henri Leimer, LGT Group has concluded the acquisition of ABN Amro. Now the hard work begins with the integration of the company. How is it going?

This work is clearly more complex than the data migration, which we concluded successfully. It is part of our style to sit down with each and every one of the 100 or so relationship managers to make them familiar with our system, to review their client portfolios, make adjustments and inquire about their needs.

We want to do this at a certain pace to make our new employees feel comfortable quickly and enable them to work. As we’ve only been growing organically in recent years, we have a lot of experience with the integration of new members of staff.

Did you see any outflows of the $20 billion in client assets of ABN Amro?

There were hardly any, no.

You are integrating an organization that is about the same size as LGT in Asia. It is bound to lead to changes.

Our platform is roughly comparable with those of big banks in respect to capacity and capabilities. This makes such an integration much easier. It would have been impossible a few years ago.

Did you have to resort to special retention measures to keep the new relationship managers?

No, we don’t need such measures. Over the past ten years, we've had hardly any departures of relationship managers. LGT has a business environment that offers a certain degree of freedom to its staff.

«We have a good pipeline of experienced bankers who want to join LGT»

We are also one of the banks that are growing. These are factors that carry an appeal with our relationship managers and staff.

So you’re having an easy time finding qualified bankers then?

Apart from the ABN acquisition, we have a good pipeline of experienced bankers who want to join LGT. Which means that we will have good organic growth this year too.

When you speak about the business environment, are you saying that good performances are being rewarded accordingly?

Not only. At LGT, we also expect a certain seniority of our bankers. In general, a relationship manager will have built up his client portfolio over a number of years at an established bank and will be familiar with the regulatory environment. That way he’s able to move relatively freely at our company.

What does the massive increase of the Asian business mean for you and the management?

We want to retain our flat hierarchy. That’s part of our DNA. Our local units in Hong Kong and Singapore should take care about their local business and not have to worry about group business.

What is the impact of the acquisition on your profitability in Asia?

It will trend upwards. We are interested in profitable growth and have achieved as much in the past.

«Today’s overcapacity won’t be one in a year’s time»

But you have to take into account that our unit is driving growth within LGT Group. That’s why you may get higher fluctuations of the cost-income-ratio than in more mature markets such as Switzerland and Liechtenstein.

Will you keep all back-office staff of ABN Amro?

About 120 of the 300 new employees are doing support work. There may be some overlap. But as we’re growing rather rapidly, today’s overcapacity won’t be one in a year’s time.

Asian growth has slowed significantly at other Swiss private banks. What is driving your growth?

We are attracting experienced bankers, because they get a platform similar to the ones of big banks and which they can use to gain new customers. At the same time, we’re only a medium-sized bank with fewer friction losses. At LGT, it isn’t the bank which is the brand, but rather the banker.

Isn’t 'the Prince’s bank’ a label that makes the bank more attractive for staff and customers alike?

For sure – in Switzerland and the European markets. But here in Asia, things are different.

«The typical wealthy Asian businessman doesn’t afford himself the luxury of fancy offices»

The ‘Prince’s bank’ label helps to reinforce the unique character of LGT, but it isn’t decisive.

How do you mean?

A small anecdote: I recently had a customer in Hong Kong, where our premises are rather modest by comparison. He told me: «Here, I feel comfortable.» At many other banks, receptions and meetings rooms were so luxurious that he automatically felt small, which was almost humiliating.

Don’t Asian clients appreciate this tendency to represent exclusivity, as promoted by many private banks?

Not really, according to our experience. The typical wealthy Asian businessman doesn’t afford himself the luxury of fancy offices. The princely aspects of LGT in Asia focus not on aristocracy, but rather the fact that clients, bankers and owners of LGT are in the same boat. And that’s what they appreciate.

LGT has only wealth management and sticks to a different banking model than rivals with their entrepreneur’s bank. Why is that?

We offer not only wealth management, but the entire product portfolio including investment services, customer-driven trading, wealth planning, loans, etc.

«We aren’t a bank for tycoons and don’t aspire to be one»

If a client needs financing or capital market services, we work together with partner banks and investment banks. This usually serves our clients fine.

How so?

In our experience, Asian customers tend to bank with several firms, partly because they want to diversify their risk. Nevertheless, we can still serve our clients holistically. This means that we offer advice for wealth and succession planning. It is part of the LGT service and not an independent profit center.

Offering corporate finance solutions would enable you to attract a different clientele?

We aren’t a bank for tycoons and don’t aspire to be one. Our aim is to offer our clientele personal and consistent advice. Compared to other companies, at LGT, the relationship manager works with his clients for years. It is not our aim to institutionalize the customers. Clients should want to bank with us and not be forced to.

How much money does an Asian client need to have to bank with you?

About two million dollars. But it is more relevant that the customer fits the portfolio of a relationship manager. It isn’t about making the client relationship profitable, but instead the banker has to generate a profit with his client book. That in turn gives him the means to build new customers. If he does a good job, he will get more assets.

Many large wealth managers are making inroads into new Asian markets in China and India. Do you harbor such plans?

The background to such expansion plans often is the need to further increase shareholder value as those institutes have a very good position already in the rest of Asia. We don’t need to do so because we have growth across the entire Asian market.

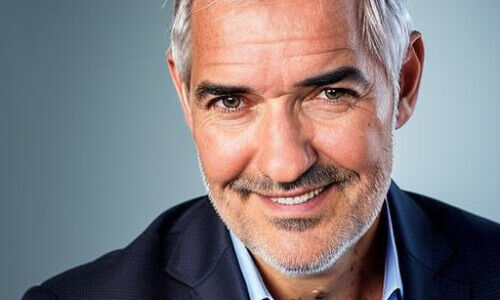

Henri Leimer is a veteran in Asian wealth management. The citizen of Liechtenstein and CEO of LGT Asia moved to Hong Kong in 1989 as a portfolio manager. In 1994, he joined LGT, which had an office in the city state since 1986.

Leimer, 60, is also honorary consul for his country in Hong Kong. LGT acquired the Asian wealth management of ABN Amro at the end of last year and doubled assets under management in the region.