UBS wants more women: chairman Axel Weber recently made an urgent plea for banks to recruit more female bankers. So, who are UBS’ most prominent women, and who are the Swiss firm’s lesser-known breakout bankers?

Zurich-based UBS is turning up the heat on efforts to attract women, Axel Weber said last week. Swiss banking is generally seen as a laggard in gender equality, but the issue has won renewed attention recently, thanks to several high-profile pushes.

On UBS' board, is intellectually cozy with Beatrice Weder di Mauro, a former economic advisor to Germany's government. She is one of four women – with lawyer Isabelle Romy, former private equity executive Julie Richardson, and insurance specialist Ann Godbehere – on UBS' 11-person board.

The CEO Whisperer

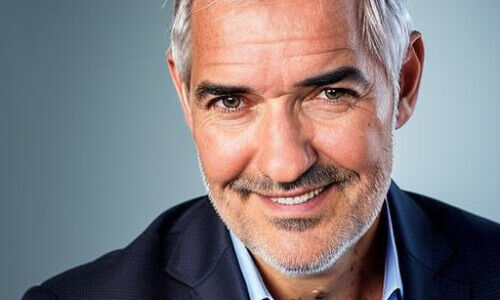

For his part, CEO Sergio Ermotti is taking counsel from Gail Kelly (pictured above), the former head of Westpac, one of Australia’s largest banks. The South African native sits in one top management's strategy pow-wows and provides advice on overall strategy, regulation and risk.

UBS wants to lift its share of women in management to one-third, from 23 percent currently. By comparison at Credit Suisse, women made for 18 percent of directors and managing directors.

So who are the key women in UBS’ business, and the up-and-coming generation of female leaders? finews.com takes a look.

The Veteran

A nearly 30-year veteran of UBS private banking, Kathryn «Kathy» Shih is one of the most respected wealth managers in Asia – not even UBS’ unseemly involvement in the 1MDB graft scandal has hurt her.

Shih ceded operational control over Asia to Edmund Koh last year, but continues to wield considerable influence as president of the Swiss bank’s Asia-Pacific activities. Shih, who turns 60 next year, has reached the pinnacle of her career.

The Wild Card

With all the right credentials – a doctorate from the University of St. Gallen and an alumni of McKinsey – Sabine Keller-Busse is perfectly equipped for Swiss banking’s C-Suite. Her current role as head of human resources vaulted her into the Swiss bank’s top management, and she has used it to advocate for gender diversity.

With experience from the private banking front at Credit Suisse under her belt, it is not unreasonable to think that the 51-year-old Keller-Busse might soon return to a banking role. She has already been mentioned by insiders as a potential successor to Swiss boss Martin Blessing, should the German-born executive be tipped for greater things within UBS.

The Billion-Dollar Manager

Citigroup banker Suni Harford is one of the U.S.’ most prominent women in finance, though little-known outside North America. UBS landed a coup earlier this month with her hire, and Harford’s job has been defined differently than that of hedge fund executive Dawn Fitzpatrick, who defected for George Soros’ family office in February.

UBS fashioned an investments head role just for her, reporting to asset management head Ulrich Koerner, whose qualifications she easily rivals. With $600 million under her responsibility, Harford’s influence will be considerable.

The Power Broker

A former fixed income managing director at Morgan Stanley, Beatriz Martin Jimenez began as Chief of Staff to overall investment bank head Andrea Orcel five years ago. She has had a front row seat to Orcel’s overhaul of the securities unit, which has won plaudits for derisking under a 2011 plan. She survived several Orcel-orchestrated shake-ups, including one two years ago which saw her promoted to the unit’s operating chief.

She is also operational head of UBS’ London branch, with responsibility for both investment banking and private banking.

The Rainmaker

Formerly the chair of Barclays’ investment bank, Ros Stephenson was snapped up by investment bank head Andrea Orcel three years ago. Her mandate? Build out UBS’ investment bank in the U.S. in mergers-and-acquisitions. Her experience as a veteran of Lehman Brothers’ private equity business has carried over to Barclays and to UBS.

Stephenson told «Institutional Investor» that she sees her role as part client-facing and part management. Her formal role is global co-head of corporate client solutions, which means she oversees M&A teams, debt and equity financing and industry and client coverage groups.

- Page 1 of 2

- Next >>