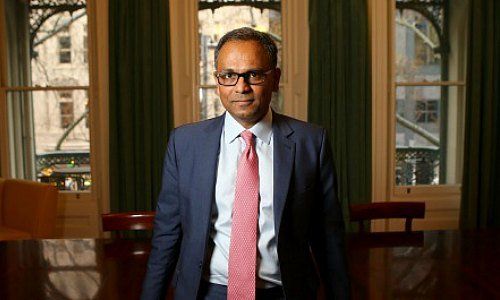

EFG International, the Swiss private bank, is widening its range of funds with a set of emerging market products. Star banker Rajiv Jain will manage the funds.

The announcement will come as an upset to Vontobel, the Zurich-based private bank: Rajiv Jain, the former star fund manager at Vontobel’s asset management unit, has come to an agreement with EFG Asset Management.

GQG Partners, a fund boutique founded by Jain, and EFG Asset Management concluded an exclusive cooperation agreement for the distribution of emerging market equity funds in Switzerland and Singapore, EFG Asset Management (EFGAM) said in a statement today. The registration of the funds is pending.

Ideal Partner

The star fund manager personally will be managing the funds. EFGAM always had focused on providing the «best of breed» funds, Moz Afzal, chief investment officer at EFGAM, said in the statement.

Jain is equally enthusiastic about the cooperation: «I have respected EFGAM for its focused and disciplined approach to investment and client service and they were the ideal choice of partner when we launched the fund in January this year,» he said.

Spectacular Success

Jain had joined Vontobel in 1994 and developed a portfolio worth more than $50 billion over the following two decades. He and his Quality Growth Boutique based in the U.S. had all the necessary liberties in performing their business. Observers agree that the citizen of India had a spectacularly successful career as a fund manager at Vontobel.

A career that he decided he should end last year. He departed in March 2016.

Sticking to His Strategy

Jain had been Vontobel’s by far best-paid employee and became seriously rich from receiving a share of the profit he generated and from performance fees. When he left the Swiss bank, he set up his GQG Partners firm in Florida with the help of a seven-member team. In December, he launched the first GQG fund.

The strategy is similar to the one Jain applied at Vontobel: Long-term investments in quality stocks with a large market cap in emerging markets. The funds invest in 50 to 80 equities in at least 5 different industries and holds a maximum of 20 percent in stocks from one country.

Painful Departure

Jain’s decision to leave Vontobel in 2016 had caused a gaping hole at his former employer, which lost several billion Swiss francs in assets under management as a consequence. And the emerging-market-funds formerly managed by Jain did much worse last year than the benchmark.

A Morningstar chart however shows that Jain's own strategy lags the benchmark so far this year. And the distance to Vontobel's emerging-market-funds is even larger, which has fully recovered from last year and is performing very well under the guidance of Matthew Benkendorf.

Australian Money

GQG currently manages $1.5 billion in assets. Most assets stem from Australia after Jain managed to attract Pacific Current Group as an investor.

EFGAM was formed in 2009 as a separate entity by EFG International. The asset management unit has some $20 billion under management and sells its products mainly in Europe, but equally so in Hong Kong, Singapore and Chile.