Management consulting firm McKinsey is pouring cold water on hopes of those betting on big gains on the stock market. Bankers are well advised to take note.

The researchers at McKinsey are feared by bankers for their razor-sharp analyses. The latest example has been released these days.

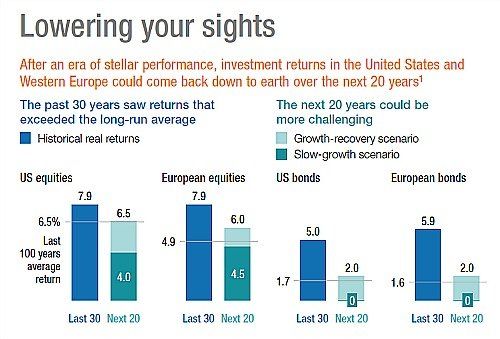

In the study, the analysts describe the future of equity markets in bleak terms, «Bloomberg» reported today. McKinsey says the return investors can expect to generate on the market will be substantially lower over the coming two decades, with «quite extreme consequences for all types of investors,» Richard Dobbs, a McKinsey director in London told «Bloomberg».

The End of an Era

The study titled «Diminishing Returns: Why Investors May Need to Lower Their Expectations» concludes that investors profited from a golden era over the past 30 years, with exceptionally high returns. Of course, some investors may not concur – for example those who took a pummeling when the dotcom-bubble burst. The times are bound to change in any case, McKinsey says.

The factors behind the extraordinary phase of growth for equity and bond investors lie now behind us, the study says (see charts below).

(Real rate of return (in percentage terms). Source: Bloomberg/McKinsey)

Listed companies in particular will find it hard to boost profits in the coming two decades and thus justify an increase in their valuation on stock markets, McKinsey argues. The main reason is the difficulty to boost profitability and employment in mature capitalist societies. Thus, the party is over.

Tough Times Ahead

Investors, traders, but also pension funds should expect tougher times ahead. An average 30-year-old will have to safe about double the amount he would expected to put aside today to maintain the standard of living over the course of a lifetime, McKinsey says.

And the generation hit hardest won't be able to rely upon banks and wealth managers that today are busy wooing them. McKinsey believes the industry is destroying more than it creates and concentrating too little on producing a performance for the customers.

Bankers will feel the heat no doubt. Taking care of youthful customers they experience as both financial illiterates and bugging wise guys won't be easy. Especially if they can't come up with the goods anymore.