The financial crisis has led to an avalanche of regulatory requirements and prompted massive demand for compliance experts. Now the trend seems to have peaked and several Wall Street banks have started reducing their numbers again as they're forced to cut their costs.

The demise of Lehman Brothers eight years ago and the dramatic consequences it had for the entire industry prompted regulators to design numerous new rules. Universal banks for instance today are forced to put much more capital aside if they want to engage in investment banking. They also have to make sure that they aren't «too big to fail».

Asset management also has become much more complex and expensive. Costly because armies of compliance officers are paid to make sure that the bankers apply the many rules to the letter.

The End of a Golden Era

The golden era for compliance officers may however be about to come to an end, according to the «Financial Times» (behind paywall). Regulation as such as peaked, headhunters are saying and therefore there will be less demand for the controllers.

The banks on Wall Street in the years of 2014 and 2015 hired a total of 13,600 financial-services experts, most of them for compliance purposes. This year, the dynamic came to an end. In the first nine months of 2016, some 1,400 jobs were eliminated, 900 of which in the legal departments. These figures show that the demand for compliance officers is cooling off, headhunters are quoted as saying.

Salaries About to Decline

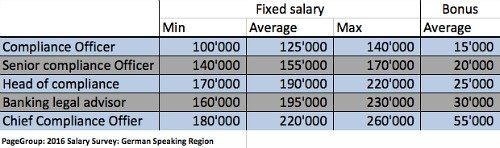

A study by Michael Page Executive published recently added an important aspect to the discussion, pointing in a similar direction. The statistics compiled showed that salaries and bonuses of employees in legal and compliance are set to decline.

A compliance officer currently earns a fixed salary of 100,000 francs plus a bonus of 15,000 francs. Managers on average receive 190,000 francs with 25,000 extra as a bonus (see table below).

If U.S. President-elect Donald Trump is to be believed, this will only be a beginning. The billionaire intends to do away with some of the regulation to kindle growth and to create jobs.

Trump's call to cull bureaucracy is welcome news to bankers who have argued that it wasn't worth offering some traditional services anymore given the costs they incurred.

A Major Cost Factor

One of them is Sergio Ermotti, the UBS boss. He frequently rails against the flood of rules. Only last week he demanded governments to cut regulation to free the economy and reward entrepreneurs.

Compliance has become a major cost factor in times when revenue is sagging anyway due to uncertainties on the financial markets and negative interest rates. No wonder are banks applying the axe at their legal departments.

Software Solutions

Goldman Sachs CEO Lloyd Blankfein expects banks to employ fewer compliance experts as soon as they completed the development and implementation of procedures, according to a recent interview. Banks also have taken to rely on software to survey transactions and employees, a trend that will also lead to a reduction in the number of staff needed in legal departments.

Of course, nobody expects sweeping cuts in the compliance units, because banks need to make sure that rules are being implemented. Otherwise, they face being sued by investors and justice authorities. Experienced compliance experts therefore still have the upper hand in pay negotiations, headhunters are saying.