Just one week before reporting full-year results, derivatives firm is in a heightened state of agitation, as documents seen by finews.com show. Management has told staff to expects «painful steps».

Leonteq’s precarious situation has been well-documented: the Swiss structured products firm has overstretched its spending budget last year while revenue ebbed in difficult market conditions.

This has been accompanied by a confused communication strategy, leading the company’s shares to tumble as investor trust crumbled. Against this backdrop, it is hardly surprising that questions over the stability and direction of the company have been raised.

Now, it appears that speculation over the firm’s direction as well as a persistent exodus of talent in recent months are forcing the hand of management, led by CEO and co-founder Jan Schoch.

Leonteq sent a message to staff on Friday in which the firm concedes major mistakes and seeks to rally the troops, according to documents seen by finews.com.

The message to Leonteq’s rank and file can be summarized in four categories:

1. What Went Wrong

Leonteq had an abysmal 2016: the firm missed revenue targets in the second half. Spending surged, especially as «in hindsight...too ambitious growth expectations under the prevailing market conditions» didn’t pan out. The firm now expects revenue of roughly 207 million Swiss francs, from nearly 220 million in the previous year.

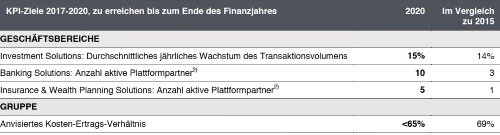

Leonteq’s cost-income ratio skyrocketed to an intolerable 92 percent, compared to 69 percent in 2015.

«We may be hired too many people at once, as human resources costs are by far the single biggest cost block we have,» management said in the memo. «We as a company feel sorry about this.»

The company’s rapid-fire personnel fluctuation are underscored by the fact that a top human resources executive in Hong Kong has departed recently. Zurich-based personnel executive, Mechtild Walser-Ertel, also threw in the towel after only a few months at Leonteq.

A spokesman for the company confirmed both departures to finews.com.

2. Immediate Structuring

In the memo, released to staff last Friday, management said «we need to take necessary and painful steps to improve our cost structure». As disclosed in November, Leonteq is cutting up to 50 jobs, which will be concluded in the next days and weeks.

The company is also deferring some projects planned for this year in favor of those which will have an immediate – and positive – effect on revenue. Management also pledged to gain back investor trust as well as to become more transparent in an effort to «avoid surprises as much as we can,» after investors were taken aback by a profit warning at the end of last year.

Leonteq conceded that not all transactions with Raiffeisen, a major shareholder, are running smoothly, primarily because some still need to be processed manually. The two institutes are making progress towards a more stable and automated set-up, Leonteq said.

The company also wants to save money by lowering its office spending. These measures are expected to affect Singapore and Hong Kong, where Leonteq inhabits prime real estate and pays top dollar for office space.

The derivatives firm opened shop in a swank Singapore location just eight months ago, where it reportedly pays a six-digit rental sum monthly.

A Hong Kong rental contract apparently won’t be renewed, according to finews.com's research – which couldn’t be confirmed.

3. Leonteq’s 2020 Plan

The firm wants to crunch its cost-income ratio back down to 65 percent, as previously disclosed in November alongside other targets (see graph).

4. Key Changes

Leonteq has been working in three business divisions – investment solutions, banking solutions, and insurance and wealth planning solutions – since the beginning of this year.

The company doesn’t plan to hire any new employees this year, and will slash spending in all departments, namely through cheaper office space.

It doesn’t plan to retreat from Asia, a spokesman told finews.com, nor are any other offices slated for closure. CEO Jan Schoch still enjoys the full support of Leonteq’s board, according to the memo.

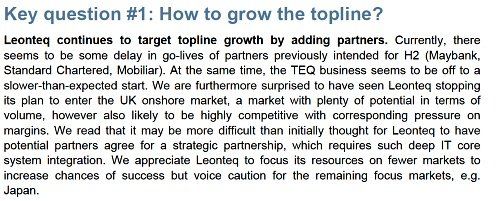

A new study by Credit Suisse has also raised questions over the sustainability of Leonteq’s growth strategy (see below). Previously disclosed ventures with Maybank, Standard Chartered and insurer Mobiliar have seen massive delays.

Leonteq has also halted plans to expand in the U.K. onshore market as well as in Norway, Finland, China and South Korea. In addition, bringing in new partnerships has proven far trickier than expected.

The company’s expansion to Japan, disclosed last year, is also fraught with uncertainty. Whether those efforts will still go forward should be addressed next week.

The firm has lowered its sights considerably, something reflected in the question of whether Leonteq still sees itself as a fintech firm. The company line is now «We are a company of experts for structured products with a superior technology, allowing us to offer better service to our clients and partners – nothing else.»

Schoch’s once-ambitious plans have definitely come down to earth.