From full-speed ahead last month to «not so fast, there»: Credit Suisse has gone from hot to cold on listing a minority stake in its crown jewel. finews.com explains why the Zurich-based firm is likely to abandon initial public offering plans for its Swiss unit.

Tidjane Thiam's language over listing a minority stake in its Swiss bank has completely reversed: Credit Suisse now has more options at its disposal other than an initial public offering for the unit, the bank boss said on Tuesday.

The comments are remarkable firstly because Thiam has conceded that an IPO was a «capital backstop» for the bank, despite insisting for most of last year the move was of strategic design, and not primarily to lift capital.

Option of Last Resort

More importantly, the comments illustrate how the bank is laying the rhetorical groundwork to back away from the IPO, the heft of which would have been a novelty in global banking.

Credit Suisse has several reasons for no longer needing the IPO, which effectively was an option of last resort to bolster its badly depleted capital.

Thiam listed the superficial ones: Credit Suisse’s capital hasn’t been as badly hit as feared by a $5.28 billion fine for mis-selling mortgage securities in the U.S.

Will It Sell?

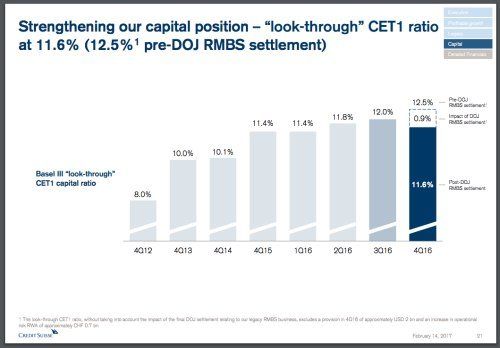

The bank has also been efficient at bolstering its capital on its own from the wafer-thin cushion of just over 10 percent when Thiam took over nearly 20 months ago (see below).

finews.com dug beneath the headlines to illustrate why Credit Suisse is likely to ultimately abandon the IPO plans altogether.

The primary reason is an economic one: the listing won't sell well. The IPO team around unit head Thomas Gottstein is peddling a solid dividend stock that runs counter to the current trend.

Banking's Trump Bump

When Credit Suisse decided to partially list the unit, Europe's banks were deeply in crisis. The election of Donald Trump in the U.S. has changed all that, juicing stocks and giving investors an incentive to return to equity markets.

After years of hemming and hawing, investors are returning to bank stocks, but they want growth stories – and are willing to take a bit of risk in the mix.

The equity story for Credit Suisse’s Swiss unit – which generates stable and reliable profits but has limited growth potential – isn’t a match for what short-term minded investors want from bank stocks right now.

Cap Hike vs IPO

«Investors may find it more attractive to simply buy Credit Suisse stock below book value and bet on a dramatic rise in value instead of buying the Swiss bank's shares, which will hardly move at all,» a person familiar with the matter told finews.com.

The Swiss unit earns most of the bank's profits, as Tuesday's results showed, but a growth story it is not. Revenue rose just 1 percent last year; assets under management moved only slightly higher.

Hometown rival UBS was the first to break ranks: banking analyst Daniele Brupbacher said last week that Credit Suisse should simply issue shares if it needed capital, not pursue an IPO.

Brupbacher's comments come as Deutsche Bank appears to be floating the idea of issuing shares to raise capital.

Qatari Retreat

Brupbacher, a sell-side analyst, isn’t responsible for UBS’ institutional asset management. But UBS is a major Swiss investor; an unfavorable view from them would put off the scores of pension funds and other institutional investors Credit Suisse would need to sell the IPO to.

Chicago-based fund manager Dave Herro of Harris Associates had already said in January he felt the bank wouldn’t need to take the Swiss unit to the capital market.

The IPO’s fate always rested with Credit Suisse’s board, and particularly with big shareholders like Harris and Qatar’s sovereign wealth fund.

We can't interpret the retreat of Qatar’s sole representative on Credit Suisse’s board in April as a clear signal – in either direction – of the emirate’s views on the IPO.

However, the timing is remarkable: if Qatar were strongly in support of an IPO, their representative would hardly have left the board shortly before the listing.

Thiam vs Real Life

The third compelling reason against an IPO is of Thiam’s design: the analytically brilliant thinker simply didn’t foresee as many practical, real-life complications to his IPO plan on the drawing board.

Several banks have listed parts of foreign subsidiaries, for example. But Credit Suisse’s Swiss unit would have been the first time a bank lists a unit of itself in its own market – and a huge one, at that.

The move gave rise to speculation that investors would arbitrage the two stocks, and that an embarrassing valuation gap between existing shares and the Swiss ones – billed «Credit Suisse, but better» – would open up.

Logistical Nightmare

Not to mention the complications and infighting within Credit Suisse itself: trading, for example, is ricocheting between the Swiss unit and the wider bank until the subsidiary builds up its own operation. Corporate governance has reportedly been found lacking by regulator Finma.

Unwinding information technology platforms as well as more straightforward shared services like human resources – it all makes for a costly logistical nightmare.

The IPO was the cornerstone of Thiam’s October 2015 strategy. The unit was to have been a consolidator in domestic banking, and offer a «unique equity story» focused on the wealthy, profitable Swiss market.

Fatal Error?

To be sure, the CEO is at pains to keep the IPO as an option, but 16 months later, the reality looks very different.

Retreating from his original plan for the IPO will cost Thiam credibility and require him to swallow his pride. It may also be a fatal error to forgo 4 to 5 billion Swiss francs in capital that the listing is likely to bring.

If recent years have shown one thing, it is that crises can manifest quickly and unexpectedly. When they do, investors and clients flock to banks with the fattest capital cushion.