The Swiss bank began showing some weakness in Asia towards the tail-end of 2016, regional head Helman Sitohang conceded to finews.com. What does it mean for growth plans?

Helman Sitohang was able to present relatively good results on Tuesday for the Credit Suisse business he leads, Asia-Pacific. The year was marked by scores of clients «regularizing» their assets, or declaring them to tax officials. In total, the bank lost 2.5 billion Swiss francs of funds in the region.

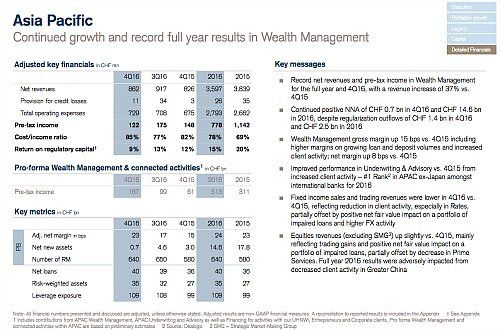

Nevertheless, Credit Suisse still managed to win 14.6 billion francs in net new money. The healthy yearly measure pales somewhat when compared with the 17.8 billion francs that clients banked with Credit Suisse in 2015; in the fourth quarter of last year, the bank won just 700 million francs in net new money.

Nervous Clients

Speaking to finews.com, Sitohang acknowledged that market conditions have worsened dramatically: high volatility has clients frozen on the sidelines and many wealthy clients, particularly in China, are hesitant to invest, he said.

Credit Suisse manages more than 168 billion francs in Asia overall, a 12 percent rise on the year. «We can be satisfied with our growth rates,» Sitohang said. «Some of our competitors didn't grow last year at all.»

Pricey Hires

Credit Suisse's growth in Asia comes at a price, as fourth-quarter results showed. The bank's cost-income ratio in Asia – how much it spends compared directly with how much revenue it generates – climbed to a lofty 85 percent in the last three months of 2016, compared to 77 percent in the third quarter.

The bank actually lowered its staff of private bankers, or relationship managers, by ten to 640 in the fourth quarter. The number of advisors rose from 590 to the 640 total over the entire year, which partially explains the high cost-income ratio.

Credit Suisse is still looking for talented client advisors, but Sitohang made it clear that he plans cost cuts and «opportunities for efficiency,» which is a diplomatic way of flagging job cuts.

M&A Boom

«Resources reallocation in the regions» is another such euphemism which simply means Credit Suisse has crack down on spending. As previously disclosed, Credit Suisse is cutting 6,500 jobs worldwide.

Asia will also be hit, Sitohang conceded, without disclosing specifics or otherwise elaborating.

A bright spot buoyed Credit Suisse's results and offset weakness in private banking: mergers and acquisitions in Asia, where the bank is organized by country and not by industry as elsewhere.

Walking Tightrope

The bank's outlook for Asia looks to be a tightrope walk: Credit Suisse has poured enormous resources into the region in the last 18 months – especially in China, where it has poached from hometown rival UBS.

In reality, the mood among investors and clients in Asia is anything but euphoric. «We have to find the right balance,» says Sitohang, and tempers expectations for Credit Suisse to ramp up further.

The bank spent much of last year establishing a presence in Thailand onshore, and had harbored similar plans for China. «We're not in a hurry,» Sitohang says now.