Flynt, the prestige project of Leonteq founder Jan Schoch, seems stuck. The digital wealth manager for the super-rich hasn’t yet received a banking license, despite its own assurances to the contrary.

Flynt, the digital wealth management for super rich and family offices and prestige project of Jan Schoch, promised to go live weeks ago. It hasn’t happened yet.

Now we know why: the federal financial-market supervisor Finma hasn’t yet given its approval. In other words: Flynt has not yet received a banking license. Peter Forstmoser, the new chairman of Flynt, explained the situation to «Handelszeitung» in an interview.

False Information

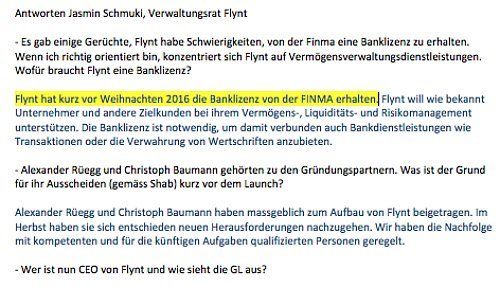

This comes as a major surprise. Jasmin Schmuki, Forstmoser’s predecessor, told finews.ch in writing that Flynt had received a banking license shortly before Christmas (see text in German below).

Schmuki, who remains Schoch’s representative on the board of Flynt, either didn’t know or lied when she spoke to finews.com at the beginning of the year. Both alternatives are uncomfortable for the new fintech bank. To claim to have a banking license, if not true, is highly unconventional unusual and dubious for a newly-founded finance company.

Doubts at Finma?

Finma probably is aware of the communications regarding the banking license. But the authority doesn’t comment, in keeping with its policy. Finma however seems to have its doubts – last autumn, rumors circulated that Finma had denied the license pending questions in respect to the management or supervisory board.

The person in question was Jan Schoch, the man behind the project and main shareholder. He had passed on the chairmanship to Schmuki in 2015. Before his decision to do so, Finma had fined Schoch’s other firm, Leonteq, for market manipulation.

Well-Capitalized

Flynt has enough capital to get a banking license. The company has a share capital of 25 million Swiss francs, according the commercial register . The board comprises Forstmoser, Daniel Halter as vice chairman, Tze Hoe Chan, a Singapore-based private-equity manager, Elgar Fleisch, a university professor at St. Gallen's HSG, and Schmuki.

Forstmoser used to be chairman of Leonteq. He told «Handelszeitung» that a banking license would be forthcoming shortly, adding that the procedure proved complicated as Flynt was going to receive a fintech banking license.

The License Doesn't Exist

And yet: Switzerland doesn't award fintech banking licenses yet. The government has plans to introduce into Swiss law soon however.

Flynt aims to focus on wealth management and doesn’t need a banking license. Observers say that the request for a license was made at the behest of Schoch, who wants it for the prestige.

Schoch is under pressure: Leonteq has suffered a spectacular slump in fortune, with the share price losing some four-fifths of its value since September 2015. Schoch’s own financial means have narrowed with the collapse in value of his company.

Change of Management

Flynt has had a difficult time too. First, the company had to delay the start to its operations. In December, CEO Alexander Rueegg and his deputy, Christoph Baumann, left Zug-based Flynt in a hurry. Juerg Frei took charge ad interim.

Since then, the company at least worked hard on its website. Flynt will offer a «wealth ecosystem», a system that puts individuals and their ambitions in life at its heart.

«Flynt is developing a proprietary technology platform that enables private and institutional clients the holistic and independent management of their demanding and complex wealth structures,» the company says on its website, adding: «For that reason, Flynt’s wealth ecosystem will be able to connect the dots of bankable and non-bankable assets to unlock mutual impacts and opportunities beyond the bankable.» Customers will retain the full control over their wealth thanks to the independent software modules.