First, the banks hired legions of compliance officers to police their business. Now these experts face the axe. And UBS looks set to define a trend.

The financial crisis and numerous scandals led to a massive buildup of compliance officers in the banking industry in recent years. They were charged with making sure that business was done according to the rulebook – avoiding damaging scandals and fines reaching billions of francs.

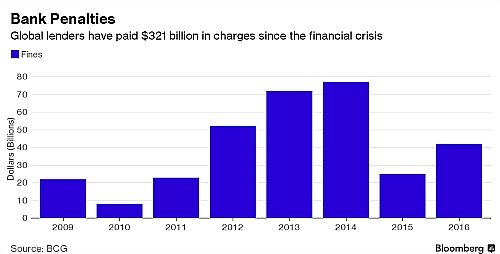

Since 2008, banks worldwide were ordered to pay a total of $321 billion in fines for various violations, according to a study compiled by Boston Consulting Group (BCG) (see table below).

The golden age of compliance seems over though. UBS for instance is replacing compliance experts with technological solution to save money, according to «Bloomberg», which cited insiders. The big Swiss bank aims to save a net 2.1 billion Swiss francs in costs by the enf of the year. Last year, UBS saved 1.6 billion francs.

Fewer Compliance Jobs

Figures have been published for Royal Bank of Scotland (RBS). The Scottish company plans to axe 2,000 jobs in compliance, according to the report. Rival banks, such as Deutsche Bank or Morgan Stanley also announced plans to reduce the mounting costs of regulating their own business.

The number of jobs in the segment is declining already, according to headhunters, who told «Bloomberg» that banks no longer acted in a state of panic.

Regtech Boom

Banks today are better equipped to deal with the ever-growing flood of regulations. Technology is playing an ever more important role in this development. Fintech companies, which specialized in the automation of compliance procedures – regtechs – are recording brisk business.

Meanwhile, some political powers propose changes that would further reduce the need for compliance staff. U.S. President Donald Trump for instance signalled that he wanted to deregulate the finance industry. One of the sticking issues is the Dodd-Frank-Act of 2010, which was designed to protect the state from cases of «too-big-to-fail».

Humans Will Remain Crucial Ingredient

Despite the banking industry’s best efforts to introduce digital solutions and deregulation, human controllers will retain their jobs for the foreseeable future. The experts supervising trading floors are the most secure in their jobs, according to the report.

Scandal involving traders such as Kweku Adoboli and Tom Hayes (both former UBS employees) damaged the reputation of the bank and provoked huge fines. And UBS CEO Oswald Gruebel even had to leave his job because of Adoboli.