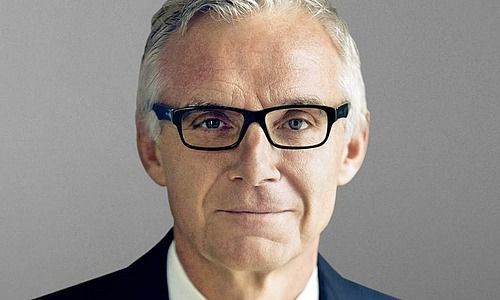

A partial concession on pay from Credit Suisse chairman Urs Rohner is hardly the result of an extensively thought-out comprehension. Instead, the move is an admission of a stupefying and arrogant mentality.

Until several weeks ago, Urs Rohner was defending his million Swiss franc salary with the same mantra as always, while ignoring the desolate state of Credit Suisse – one that he, as chairman of the Swiss bank since 2011, bears the ultimate responsibility to shareholders for.

Friday's voluntary back-down is alarming in two respects: Rohner's audacious attempts to pay himself a handsome salary with little to no correlation to the development of the bank in the last two years, as well as one which he knew would be fought vociferously by shareholders and the wider public.

Lost Out

Neither elements display much sensitivity – not to mention the purely business and economic considerations underpinning the issue – which a high-profile chairperson is meant to possess.

Credit Suisse's caving to pressure on pay is an unquestionable admission of how opportunistic and short-term Credit Suisse board's thinking is: the Swiss bank waited until it was backed into a corner by angry and highly influential shareholders to review its pay policies.

In other words, the bank's top ranks took a punt – and lost.

What Now?

The fallout of Credit Suisse's capitulation is that Rohner, as well as the top Credit Suisse echelon who had been in line for a rich payday, have lost all credibility.

Many observers and shareholders will be asking themselves, as the bank cleans up the pay shambles before an April 28 shareholder meeting, what Rohner's legitimacy to remain in the job is.