Cheese, chocolate, watches...and private banks? Switzerland’s financial advisors to the wealthy want to position themselves alongside the country’s best-loved exports. finews.com checks on their progress.

The end of banking secrecy and ultra-low interest rates have dramatically lowered profitability in the private banking industry, while money-laundering and tax scandals have persisted.

Led by Boris Collardi (pictured below) of Julius Baer, the industry is stepping out of the shadows and seeking a reboot alongside Switzerland’s most cherished exports like fine chocolate, luxury watches and Swiss cheeses.

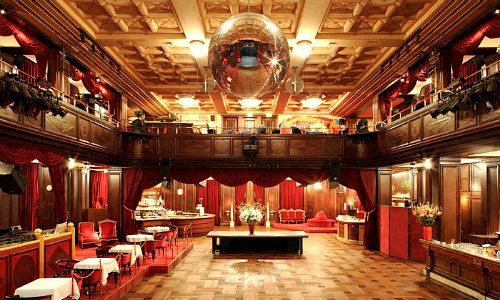

«Private banking is an export industry, but that’s not very well-known among the wider public and needs to be embodied more strongly,» Collardi told the capacity crowd of private bankers at annual meeting of the Association of Swiss Asset and Wealth Management Banks (ASPB) held at Kaufleuten, a more than 100-year-old merchant's hall.

«Disagreeable» Standards

Private banks suffer a comparable currency blow from the strong Swiss franc as the machinery, tourism or watchmaking industries, Collardi said, yet few outside of finance realize this.

He urged Swiss private banks to arrange themselves with «disagreeable» international standards – perhaps referring to exchanging data with countries like Russia and Brazil, who are part of a second batch of countries to adopt automatic exchange of information from next year.

Private banks should also reconcile themselves to a working relationship with the European Union, «whether we like the direction in which it is developing or not.»

Mystique of Ultra-Wealthy

An export product? By gross domestic product certainly. The ASPB’s members cater solely to the needs of wealthy individuals, some still run by partners who are partly or entirely liable for losses.

More typical exports like champagne truffles, Breitlings and Gruyere are known – and loved – the world over. By contrast, private banks are rarely seen or heard, save for popping up in money scandals – from Uzbekistan to Brazil to Malaysia – with impeccable regularity.

The thrive on the mystique surrounding wealth that is unattainable for most. Collardi’s charm offensive thrusts an industry that may not be ready for its close-up into the spotlight, a point highlighted by a member of government.

«If we’re going to promote your industry as a Swiss export, then we need to win the base at home: the public. This seems to me to be out of balance,» finance minister Ueli Maurer told the bankers.

Wine vs Water

Switzerland’s truly private bankers have largely escaped a pay backlash because most institutes aren’t listed, and partners can pay themselves whatever they like. In fact, several private banking families are rich enough to rank among Switzerland’s wealthiest.

(Thomas Kupfer, Switzerland's ambassador to Singapore, at left with finance minister Ueli Maurer, right)

Maurer exemplified this divide by co-opting remarks made by Thomas Jordan, who runs Switzerland’s central bank. Jordan had joked earlier that the industry couldn’t have been all too hard-hit by negative interest rates, since he had still been served excellent wine at a dinner hosted by the bankers the evening before.

Maurer said he, like Jordan, also had a working dinner the evening before: bottled water and sandwiches while poring over tax reforms in Bern.

Bern's Embrace

The remark exemplifies how far private banks have to go in endearing themselves and winning hearts and minds.

To be sure, it was a coup that the right-wing Maurer took time away from government business to show up at all. It is a sign of increasing political clout for the finance elite – a key component of its future success. Other Bern representatives included liberal green politician Martin Baeumle and Christian Democrat Kathy Riklin.

One private banker welcomed Maurer’s embrace, saying that «anything would have been an improvement» over the previous finance minister, Eveline Widmer-Schlumpf, who oversaw the burial of banking secrecy amid massive pressure from the U.S.

Sovereign Wealth Fund?

Maurer, who went on to compare Swiss private banks’ expertise, precision and know-how to that of Swiss watchmaking, said he envisaged more joint government and private sector efforts like a recent Asia trip.

He also said the government is examining a sovereign wealth fund in which private banks could also invest, «because you complained that you have too much money and too few investment opportunities,» as he put it.

«This is another example where it may behoove us to work together, but there are still many hurdles to clear.»

Host of Worries

Bern as the savior for Switzerland’s white-glove private banks? Not quite: business in private banks’ main hunting ground – Europe – is drying up, and Bern has gained little traction in a long-simmering standoff with the European Union. Expansion into Latin America, the Middle East, and Asia has proven costly and time-consuming.

Negative interest rates will also remain a worry for the foreseeable future: banks paid a total of 1.5 billion Swiss francs to the central bank last year in charges for franc deposits. Margins on interest rate business have crumbled, and the industry is desperate for them to turn positive again.

Pooling Private Planes

With the SNB hamstrung by Europe’s beleaguered financial straits, this is unlikely to happen anytime soon. Over lunch that included beef fillet and smoked salmon, finews.com spoke to several private bankers who bemoaned the industry's current predicament.

A Genevan banquier warned that he only had a few minutes to talk, as he was hitching a ride back home on a rival's private plane. In Swiss private banking, the age of austerity means private plane carpooling.