Swiss finance startups have attracted a substantial amount of risk capital last year, according to a Swisscom survey available exclusively on finews.com. The main source of capital injections may however be about to shift, much as it did in Silicon Valley.

The complaints may have been premature – exponents of the Swiss fintech industry repeatedly have bemoaned a lack of investors in the country.

The fintech industry has attracted investments amounting to 168.05 million Swiss francs last year, Johannes Hoehener (pictured below), the head of the fintech cluster at Swisscom, told finews.com.

Takeover activities generated investments of 107 million francs (mainly through the purchase of Money Park by Helvetia insurance group), while risk capital investments amounted to 61.05 million, calculations by the Swiss telecommunications giant showed.

Swisscom registered 37 investment rounds, including two mergers.

Insurtech Is the Flavor of the Day

The amount of money involved places Switzerland in the middle of financial markets globally. In Europe, the U.K. generated $609 million, Germany $376 million and Scandinavia $76 million.

Swisscom expects the figures to rise in future, with investments in Swiss fintechs due to increase this year.

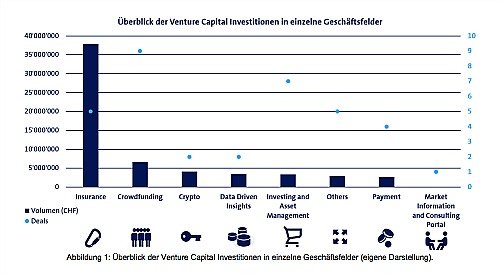

The segments don’t do equally well. Insurtech, which arguably has not been the most prominent among the sectors, has attracted the most money last year, with 38 million francs.

Hoehener said that the figures showed that investors expected insurtech companies to do particularly well. Crowdfunding is a further phenomenon to have taken off, with nine deals accounted for in 2016 (see table below).

Zurich Calling

For a fintech entrepreneur it makes sense to place your company in or close to Zurich. Many startups are located in the financial capital of Switzerland and they also attract most capital, according to the Swisscom statistics. The region of Zurich offers an attractive eco system and the size of the city and its role as a financial market further increases its allure, Hoehener said.

Zug, Bern and further cantons in Central and Western Switzerland follow behind Zurich.

What seems less settled are the sources of the investments. Risk capitalist stumped up 70 percent of all investments last year (see table below). Private investors added another 16 percent and established financial-service companies were behind 14 percent of the risk capital.

No More Disruption

The share of latter is likely to rise, according to Swisscom. The established companies will likely have a greater share of both risk investments and takeovers.

In Silicon Valley, the established financial companies already have taken over a larger part of the business, taking the place of the business angels. Large corporations are increasingly taking charge of matters in the center of the global fintech industry, companies that once were the target of the startups – disruption isn’t the hottest word in fintech anymore.