Swiss banks have been groaning under the weight of negative Swiss interest rates for more than two years. But abandoning the surcharges on francs would be just as disastrous, a new study shows.

Switzerland is a «leader» in negative interest rates, or levying charges on Swiss franc deposits held at the central bank. Swiss banks have had to pay 0.75 percent to the Swiss National Bank on deposits, a bid to dissuade franc investment.

This won't change anytime soon: the SNB showed no sign of stepping away from the method at its quarterly rate-setting meeting last week, underscoring instead the importance of negative interest rates in its toolkit.

Policy-makers are showing little compassion for banks. A rise in mortgage loans and more competition from outside of banking have banks sweating as negative interest rates eat into their interest income. UBS and Credit Suisse are additionally burdened with requirements for an extensive capital cushion.

Status Quo Until 2018

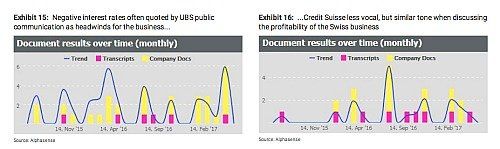

Understandably, it is the big banks which complain the loudest about about negative interest rates (see graph below).

«How much longer» is the refrain among Swiss banks on franc surcharges. While the U.S. is turning its back on the masses on cheap money by tightening policy and even the euro zone shows signs of perking up, Switzerland has little reason for optimism. Strategists are betting on the Swiss central bank to keep the negative rate regime in in place until at least the end of next year.

Less Pricing Power

Would banks breath a sigh of relief if Switzerland abandoned the 0.75 percent surcharge on francs? To the contrary: analysts from Morgan Stanley warn in a new study that a marginal walk-back of the negative rate regime without a clear policy direction would actually be disadvantageous for banks.

Banks would be hard-pressed to pass on what is effectively a price hike to their clients as in 2015, Morgan Stanley argues. Then, the banks effectively collectively raised mortgage rates – even though they should have lowered them, in line with monetary policy.

The American firm said banks wouldn't be able to pull off such a move again – not least because there is non-bank competition for mortgages now.

Return to Positive Territory

This would still be immensely preferable to the SNB's widening of its negative rates regime. Morgan Stanley calculates that another 25 basis points would wipe 2 and 3.5 percent off the profits of UBS and Credit Suisse, respectively.

Another move lower would also shock investors, who aren't pricing in a further cut.

Relief for banks can only come from a rapid unwind of negative interest rates and a return to «normal» interest rates in positive territory, as Wellershoff & Co predicts. Given the SNB's extremely cautious current leadership, this seems extremely unlikely.