Has EFG International bitten off more than it can chew with the acquisition of rival BSI? finews.com takes a look at the deal’s crucial next six months.

EFG International held fast on its plan to buy rival BSI even after the Swiss rival imploded over its 1MBD links. The Malaysian scandal wrought havoc on the Ticino-based private bank, shuttering its Singapore branch and drawing heavy sanctions from regulators.

Last year, Zurich-based EFG’s chairman John Williamson conceded nervously that he was unsure where the bank’s journey with BSI would lead. The deal has officially been concluded, but the next six months are crucial to its success. finews.com looks at the hot spots foremost in the mind of Chief Executive Joachim, or Joe, Straehle.

1. Stop the Bleeding

The massive 5.5 billion Swiss franc asset bleed in the first months is startling, but not completely unexpected. In fact, EFG’s private bankers brought in 500 million francs in the period, but the net result were withdrawals due to BSI bankers – and clients – leaving, the bank's exit of unprofitable markets, Italian clients leaving amid central bank scrutiny, and voluntary tax disclosure schemes.

The bank can do little about BSI, but must make a success of its «retain and regain» scheme to keep assets when advisors leave.

2. Add Private Bankers

In fact, advisors do leave EFG, which is run more like a entrepreneurial collective of private bankers than a traditional bank. In the first six months, 26 of them in total wandered out, mainly in the Latin America and Swiss business.

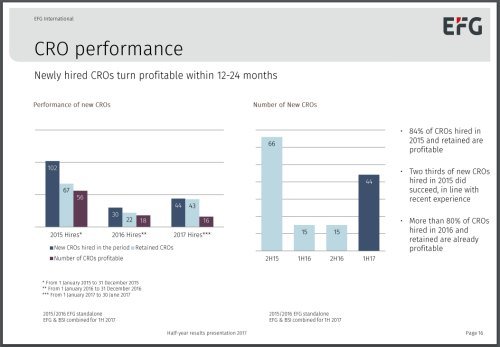

That isn’t to say EFG isn’t hiring – it took on 44 on the first half – but it is losing bankers at a faster clip than it can keep them. The bank traditionally gives private bankers roughly two years at most to turn a profit (see slide):

The good news is that banker productivity is up: more than 80 percent of those hired and kept on last year are profitable. The problem isn’t profits – it is finding and keeping the most productive of bankers. Straehle, a well-known Swiss banker and veteran of Credit Suisse and Sarasin & Cie, will have to spend much of his time wooing talent.

3. IT Headache

For a bank which sweated out the 1MDB scandal last year, it is hard to imagine an even stiffer headwind. But EFG’s information technology migration in Switzerland later this year looms, and it is formidable. BSI runs on Avaloq software, while EFG has decided for rival Temenos.

The bank spent nearly 100 million francs in the first half integrating BSI –to roll out a new logo, for example. EFG says integration costs are actually expected in the second half to «accelerate,» which in English means to rise, due to the migration – clearly, merging the two software platforms is no small task. With data migration testing currently ongoing, formal migration takes place in the fourth quarter. The bank says it has contingency plans in place in case of a data snafu.

4. Italy

EFG’s problems with Italy’s central bank are emblematic of the potential for unpleasant surprises that chairman Williamson alluded to. The bank’s offices in Como and Milan, inherited from BSI, might be shut after Italian officials found «administrative weaknesses» from prior to the deal. EFG has enforced far stricter compliance and other rules at its Italian branches following the rebuke, but the damage is done.

One of the strengths of BSI, a Lugano-based bank with a rich 144-year history, would have been its proximity to the Italian market and potential to tap onshore fortunes. Following the 1MDB scandal, it is unfortunate, to say the last, that BSI has managed to besmirch itself in its own backyard.