Vontobel is taking its structured products business to Hong Kong. The Swiss firm's head of investment banking details the expansion plans and profit goals to finews.ch-TV.

The Zurich-based bank is one of the largest issuers of structured products in its home market and has a strong presence in several other European markets. Now, the firm is taking its investment banking know-how to Hong Kong, where it launched two structured products on the Hong Kong Stock Exchange, HKEx, on Tuesday.

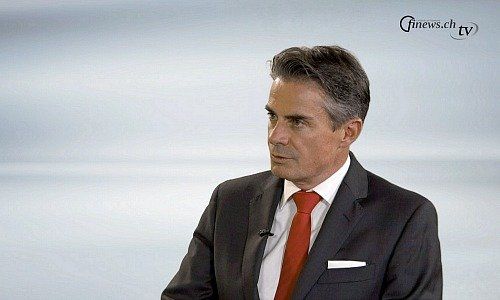

Vontobel's long-term goal is a revenue split across its businesses of one-third each from Switzerland, wider Europe, and Asia, investment bank head Roger Studer told finews.ch-TV in an interview.

The Swiss bank wants to quickly ramp up to roughly 600 structured products in Hong Kong, which in today's market size translates to 10 percent market share. The small Swiss firm is entering territory that is dominated by heavyweights like J.P. Morgan, Societe Generale, Goldman Sachs and big Swiss banks UBS and Credit Suisse.

Studer assured that Vontobel, which has moved staff from Singapore to Hong Kong as well as hired roughly one dozen financial engineers, traders and other specialists, is in the business for the long term.

«We need to be there, be good, and work hard for the next few years and that will help us with these capabilities to really grow the Hong Kong market sustainably,» Studer told finews.ch-TV.