The sudden departure of Walter Berchtold as head of Falcon Private Bank caused a rupture at the institute, which the company tries to respond to with a new branding campaign next month.

Walter Berchtold (pictured below) is a strong name in Swiss banking, with his past at Credit Suisse (CS) and an untainted reputation to go along. When Falcon Private Bank last year presented him as new chief executive officer at the height of their problems in connection with Malaysia’s 1MDB state fund, the general sense was one of great relief.

The good fortune evaporated as quickly as it came as Berchtold quit his job last week. And the rulers of Abu Dhabi, who also run Falcon, faced a double whammy as the chairman, Christian Wenger, decided to leave the bank at the same time as Berchtold.

And last but not least came an announcement that the global head of products and services, Arthur Vayloyan, also was to depart, the man behind the repositioning of the bank.

Turnaround Complete Soon

The bank, which has its headquarters in Zurich, won’t buckle and promises to complete the turnaround phase in October. The company is set to launch a re-branding campaign, retaining the name of Falcon Private Bank, a spokesman confirmed.

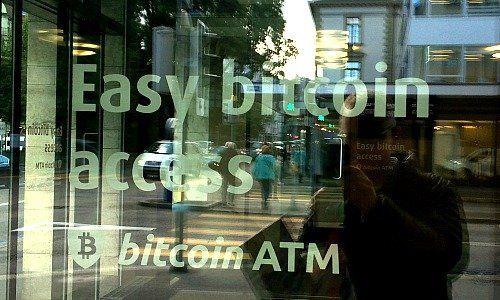

The owners will also replenish the ranks of the supervising board and present a name for chairman by year end. And Falcon will launch a series of further projects including a digital banking program. The bank in April signed an agreement with Swiss fintech Move Digital and recently opened a bitcoin ATM in Zurich, creating headlines for the right reasons again.

Rejected as a Stakeholder?

Time will tell whether the moves by the bank will come soon enough to divert attention from the home-made crisis among the top executive. Sources close to the bank said that Berchtold sought to take a stake in the company, positioning himself as a financial entrepreneur and that he had been rejected in his quest by the rulers based in the Middle East.

As a consequence, he pulled out. Martin Keller, a member of the supervisory board, took over as chief executive officer.

When Berchtold jumped ship, Vayloyan decided to leave as well – according to media reports because the head of products harbored ambitions to become the CEO himself.

The bank now faces the challenge of having to contain the situation and to stop the rot. After all, Berchtold in recent months hired a string of bankers with a past at CS, the same company that his career and good reputation is closely linked with. Falcon has to turn the tide to keep those bankers on board.