UBS installed a digital factory in the heart of Zurich’s financial center in a bid to help the company tackle the challenges it faces through digitization. Here’s what the bank is working on and what this has to do with the new iPhone.

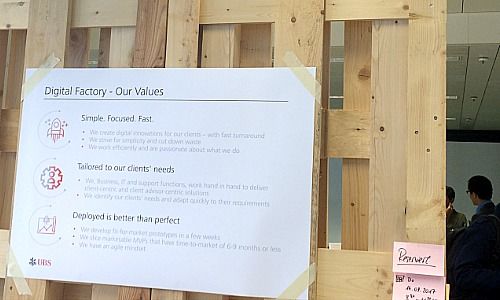

UBS, Switzerland’s largest bank, in March opened its so-called digital factory on Paradeplatz, the heart of Zurich with its luxurious hotels and posh shops. The hundred UBS employees who currently enjoy the plush surroundings are working on the bank’s digital projects. Of course, eventually they will have to move to new offices, because the representative building doesn’t really fit the bill.

Still, the top echelon of the bank has lent all the necessary support to the makers of digital banking. It will be here that the second wave of digitization in banking at UBS Switzerland will take shape. The project managers expect to display the entire banking process from customer to the back-office, end-to-end so to speak.

Access – Whenever – Wherever

The other key component of the digital factory is about enabling customers to access UBS services at all times through various channels, pretty much like the colorful applications of smartphones that open whenever the owners wishes them to. «Apple has shown how it works,» said Andreas Kubli, head of multichannel management and digitization at UBS Switzerland.

Kubli, together with Stefan Arn, head of IT at wealth management, is leading the work in progress at the digital factory. And the mix of software developers, programmers, compliance experts and relationship managers in the factory make for a busy environment. Kubli and Arn are eager to make digitization a democratic process at the bank.

The cooperation between specialists of all the segments improves the way products are being developed and brought to maturity, with fewer misunderstandings as a consequence. And those are costly when large projects are undertaken.

Reversal of Trend

The digital factory also spells good news for Switzerland as such: instead of relocating everything IT to countries such as India and Poland, UBS moved fewer, but better qualified experts close to where the banks heart beats – a reversal of trend. The writing has been on the wall for a while – and finews.com reported about it.