Fintech was born out of traditional finance's moral decrepitude. This past year shows that the budding industry's young Turks in Switzerland have lost their innocence.

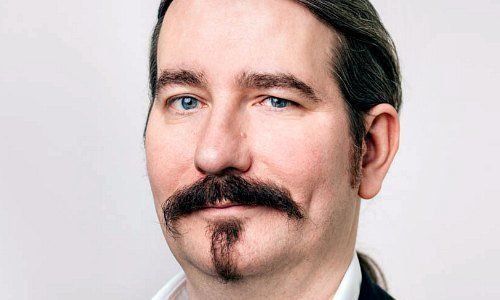

Niklas Nikolajsen (pictured below) is the epitome of a finance rebel: long hair and Errol Flynn beard paired with a fighting spirit and an assiduous social media presence have helped cultivate the «finance pirate» image of Switzerland's fintech scene.

The Danish-born software architect has also grown very wealthy, as the boom in cryptocurrencies fills the coffers of Bitcoin Suisse, the platform he co-founded four years ago. Nikolajsen is already a bitcoin billionaire – replete with a corporate hockey team and a new Bentley, as finews.com reported recently (in German).

To be sure, the crypto pirate has arrived in the establishment of finance, with all the trappings including a luxury car, a mansion in a tax-friendly village, and monogrammed shirts.

Smart Tech, Not WMD

It is exactly this caste that fintech's pioneers had sought to challenge: Masters of the Universe who had been demystified during the financial crisis. Fintech was meant to simplify clients' lives with smarter technology, instead of shilling financial «weapons of mass destruction,» as legendary American investor Warren Buffett once described derivatives.

And unlike the pinstriped mercenaries of banking, fintech pioneers traditionally poured their own funds into developing new technologies. The contrast to traditional finance is often underscored in superficial appearances: «fintechies» reject the suit-and-tie uniform of banking in favor of an eclectic urban mix, often with a hipster beard.

In Switzerland, the last few months have shown that the young Turks are more like their traditional finance brethren than they would like to admit: fintech has fallen into patterns easily recognizable from the «old» financial establishment.

Same Toxic Mix

One idol of fintech, Jan Schoch (pictured below), der who co-founded Leonteq long before fintech was a term. The entrepreneur suffered several painful setbacks this year, culminating in his exit from the derivatives specialist in autumn. It isn't Schoch's fall that has given observers pause – failure is an integral part of fintech, with some experts estimating that north of 90 percent of firms perish.

Instead, it is the way that Schoch crashed with Leonteq: a toxic mix of hubris, stubbornness and resistance to advice, highly illogical growth ambitions, and broken promised paved the way for his fall, as finews.com reported. With Schoch, Swiss finance has its Icarus.

Welcome to «Klepto Valley»

Swiss banking also has several black sheep: the alpine nation's regulator Finma put the kibosh on several crypto scams, and said it is investigating more than one dozen more. The news surfaced as a bitter dispute broke out between cryptocurrency Tezos' developers and a Swiss-based foundation set up to govern its assets. The spat has drawn attention globally, threatening to make «klepto valley» of what its proponents would like to brand «crypto valley».

Opaqueness, fraud schemes – not exactly laudable for a sector which set out to put its clients at the center of its attention. Finma's efforts to expose «crypto fakes» show that fintech is no haven for selfless do-gooders.

Well-Worn Bonus Argument

In fact, the search for personal profit and wealth is just as prevalent in fintech as in traditional finance. Firms pride themselves on paying «market going rates» in order to lure talent from banks. The argument is the same well-worn one as from notable bankers like Sergio Ermotti, and the payments burn risk capital put up by investors.

The trend isn't sustainable without profits quickly following, and may be one reason why digital insurance broker Knip, a beacon in the fintech scene, was forced to partner with a Dutch tech giant this year. To be sure, many fintech pioneers give Bentleys and bonuses a wide berth, but the past year's examples show that fintech is burdened with the same human flaws as traditional finance.

Why shouldn't it be? Most fintechies in Switzerland harken from tradtional finance. So beware when traditional, established banks cultivate a «fintech type» to bolster innovation within the firm. It may simply be a further sign that the young Turks have arrived in the establishment.