Yes. It’s the same thing with Trump. I like him very much, he is a very nice man. Privately, he is spectacular, he really is. Very much the gentleman, very nice. But, I need to be my own person.

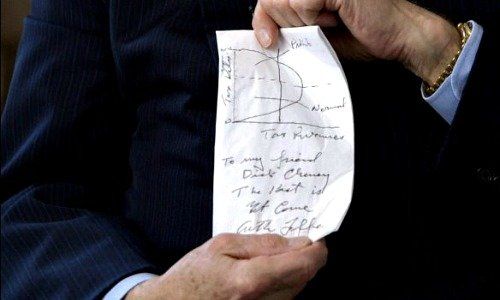

You became known as the father of Reaganomics. Based on the Laffer Curve, a model of optimal tax return, you advised Reagan to cut taxes. Is the situation today comparable to the situation of the 1980s?

Yes, with one difference. In the 1980s the government wanted to delay the corporate tax cuts for one year. This time I showed them all what happens when you delay a tax cut. And I got them to reverse their policy. So we did not delay the tax cut. The difference is that we won’t get a depression like in 1981/1982.

Businesses don’t like paying taxes. They hire lawyers, accountants, deferred income specialists – they spend lots and lots of money figuring a way around paying taxes. If you look at the statutory tax rate before now, it was 35 percent. Yet the effective tax rate is only 13 percent. The fact is, they come up with those tax-sheltering schemes to lower their tax bills. If you’re lowering the tax rate from 35 percent to 21 percent, what happens to tax sheltering? It will disappear. The academic literature shows that tax sheltering alone will pay for the tax cuts. Two thirds of the tax base is sheltered. If you cut the tax rate, sheltering isn’t so attractive anymore and you will pay your damn taxes.

«I often forget that you are in fact Europeans. I almost regard you as free-market Americans»

At 35 percent, tax evasion is much more attractive than it is at 21 percent tax rate. After the cuts, you will find much less tax evasion. Tax evasion alone will pay for the static revenue losses from the reduction of taxes. Then we get the issue of corporate headquarters. If you have a 35 percent tax rate and a country x has 25 percent, you will move your corporate headquarters to that country. When we lower it, they are going to come home.

Do you know our attractive tax system in Switzerland?

Yes, I do. I often forget that you are in fact Europeans. Because I almost regard you as free-market Americans. You are the only group outside the U.S. in the whole world who actually believes in free-market economics. You sound like them, but you’re not like them.

Anyway, you will see a lot of shifting. That will bring a lot of money. We’ve already had Apple – $38 billion! Do you know what that does to offset the static revenue?

What will Trump’s policies mean for the banking industry? We’ve had a decade of new laws and regulation weighing on the entire industry.