Crealogix is shopping itself to potential buyers following a strategic repositioning, according to market chatter. The Swiss fintech firm denies sale talks – sort of.

Zurich-based Crealogix is looking to sell itself, finews.com has learned. A sales dossier is making the rounds of potential buyers, according to two separate sources familiar with the matter. The fintech firm has also mandated a bank – Credit Suisse – with finding a buyer, according to the people.

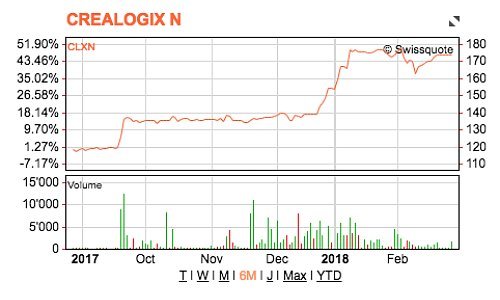

The firm's stock price suggests something is afoot: Crealogix shares climbed to more than 176 Swiss francs a share from 140 francs from December to January – with no newsflow or other factors buoying the stock.

Dramatic gains like that of Crealogix (see above) are often an omen for impending corporate action, such as a sale.

Favorable Timing

The timing would be favorable for Crealogix shareholders: after years of stagnation and a sleepy start to the digitization boom, the firm has hit its growth stride. Shares in the 22-year-old firm have advanced more than 60 percent in the past year.

Its market capitalization is roughly 190 million francs – a heady sum for a firm which was until recently loss-making and recorded an pre-tax profit of just 7.3 million francs. If Crealogix is selling, there has never been a better time since its founding in 1996 to do so.

Close Ties

But Crealogix isn't selling – at least according to Chairman Bruno Richle (pictured below), who told finews.com on Tuesday that «It isn't true that Crealogix's shareholders want to sell the firm, and it isn't true that Credit Suisse or anyone else has a mandate from us to do so.»

The firm and Credit Suisse have long maintained close ties: Richle and Richard Dratva, strategy boss and vice-chairman on the board, built Directnet for Credit Suisse in 1997 – Switzerland's first internet-only bank. Credit Suisse is also the firm's house bank, and through its asset management arm holds a substantial portion of Crealogix.

Frequent M&A Talk

Crealogix remains controlled by its founding shareholders: Richle holds 23 percent, Dratva 24 percent, Daniel Hiltebrand 14 percent and Peter Suesstrunk 3 Prozent. They have unified their interests in a shareholder pool.

Richle said he can only speculate on where the sales talk got started: «M&A is a fixture in our industry. Is is true that we have had proposals,» Crealogix's Chairman said. «We want to be a buyer and not a seller.»

International Plans

To be sure, the fintech and banking digitization sectors are on a high, both battling for the upperhand with clients and to dominate technology. Crealogix has been a consolidator in the past, with several acquistions to support its strategic expansion. Three years ago, the firm bought Germany's Elaxy, an advisory soludtions provider. More recently, Crealogix bought Barcelona-based fintech Innofis.

- Page 1 of 2

- Next >>