Patrick Liotard-Vogt wanted to reinvent private banking after the following crisis. But the flamboyant entrepreneur is forgoing banks with his latest move.

Investing in a social network? A Small World could make it possible, the firm said this week as it unveiled plans to list its shares on the Swiss SIX Swiss Exchange. The firm doesn't plan to issue new shares as part of the listing, which is meant simply to raise its profile and enable existing investors to trade their shares.

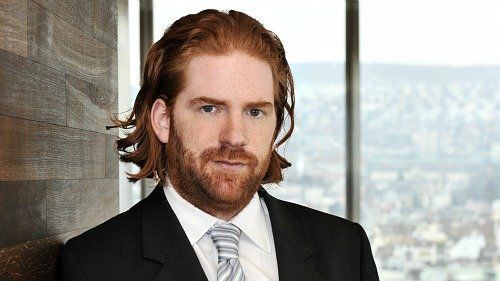

Patrick Liotard-Vogt is behind the unusual offering. The entrepreneur owns ASW Capital, which is A Small World's majority shareholder. Billing itself a «private international lifestyle club,» the social network has an illustrious past – including once being owned by disgraced Hollywood mogul Harvey Weinstein.

A Small World said it has attractive growth prospects thanks to a scalable business model, according to its statement. Because the firm didn't issue any new shares to list, it also doesn't need a bank to accompany the move, though it did draw on the advice of a «renowned» law firm.

«Private Banking Reloaded»

Liotard-Vogt joined the board of Basel's Sallfort Private Bank back in 2012, when he and the private bank's management launched «private banking reloaded» in a bid to appeal to a younger clientele with a digital wealth offering. The push ultimately fizzled.

One year later, he moved to the Caribbean, ostensibly because a luxury resort he developed in St. Kitts required his full attention. According to Swiss newspaper «Handelszeitung» (in German), Liotard-Vogt left a trail of debt and business disputes behind.