Swiss consumers are increasingly using cashless payment systems, but not the ones available on their smartphones – a headache for the providers of such systems.

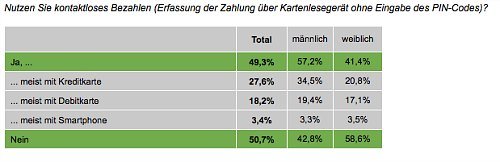

Swiss consumers by and large are using either credit or debit cards if they pay cashless. And contactless cards have become popular as well. Almost one in two consumers is using the possibility to pay without making physical contact between payment card and terminal, according to a survey published by Comparis on Monday (in German).

Despite the massive efforts by banks to push systems available on smartphones, consumers in Switzerland so far have shunned those means. Payment systems such as Twint, Apple or Samsung Pay have remained on the fringes so far, according to Comparis.

Too Complicated and Incompatible

A lot of consumers seem to believe that Twint et al are more complicated than their older, card-based systems.

Only 1 percent of the surveyed mentioned Twint, Apple Pay and Samsung Pay as their preferred means of payment. About 3 percent are using their smartphone to pay for goods and services otherwise.

No Future for Smartphone Payment?

One of the main reasons why consumers are shunning smartphone payment system is their incompatibility, Comparis said.

Only about 38 percent of consumers think that smartphone-based systems will take over from credit and debit cards eventually.