The number of customer advisors working in the Asian growth region has risen markedly over the past year. The Swiss banking fraternity however is facing a challenging environment there, as finews.com shows.

The ten largest banks operating in the Asian growth market last year increased the number of customer advisors by almost 10 percent compared with the year-earlier period. Excluding acquisitions the growth reached 4 percent, the Hong Kong financial journal «Asian Private Banker» reported this week.

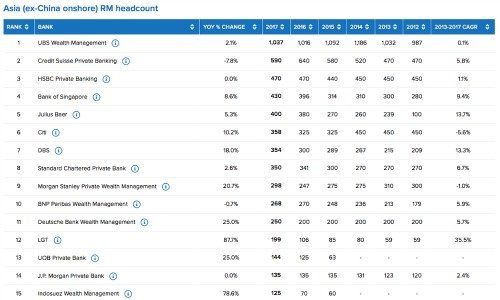

The position of the Swiss market players is illuminating: While market giant UBS raised its pool by 2.1 percent to 1,037 advisors, arch-rival Credit Suisse (CS) only employed 590 advisors by the end of 2017, a decline of 7.8 percent (See accompanying table).

CS head Tidjane Thiam last November ascribed the drop to the digitalization of business processes, as reported by finews.ch. The long-term goal for CS is to push the number of advisors back up to around 800, Thiam stressed.

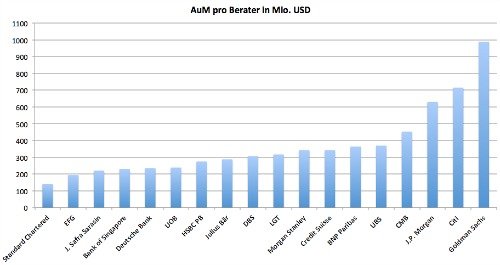

The development of advisor numbers compared with the managed assets makes for interesting reading, as this analysis by finews.com shows.

1. Americans lead the way

One customer advisor in 2017 managed on average 340 million dollars, with the American banks leading the way. Thus a Goldman Sachs advisor was responsible for around one billion dollars (see table). At Citi and J.P. Morgan it was 715 and 630 million dollars respectively.

The key figure is an important indicator of the bank’s efficiency: the American banks lead the way because of the high entry point for managed assets. So Goldman Sachs will only accept clients with assets of at least 10 million dollars.

2. ...EFG and J. Safra Sarasin at the other end

The table also shows that Zurich-based EFG International and the Brasilian-Swiss J. Safra Sarasin operate on clearly lower assets per advisor. EFG last year also ran into problems with the takeover of the Ticino private bank BSI, which was involved in the 1MDB scandal.

The result was an outflow of billions of francs of client assets. At the same time the bank was facing a trend change, the previous EFG head Joachim Strähle told finews.ch-TV in an interview last September.

3. UBS ahead of Credit Suisse?

As far as managed assets (Assets under Management, AuM) are concerned, UBS is not only 50 percent larger than Credit Suisse (CS), but it also leads its rival in terms of efficiency. Thus a UBS advisor manages on average 369 million dollars, while his or her CS counterpart is responsible for around 343 million dollars.

In addition UBS managed to raise its 2017 customer assets by more than a third from the previous year to 382.7 billion dollars, without increasing significantly the number of client advisors or by executing any takeovers (see table above). CS however also increased its annual asset base in Asia, while at the same time cutting the number of client advisors.

4. A leap forward thanks to acquisitions

The largest growth in advisor numbers was achieved by the Liechtenstein bank LGT with almost 90 percent. This however also includes staff from the Dutch bank ABN Amro Asia, which LGT integrated last May. This boosted assets by more than 90 billion dollars.

EFG also boosted advisor growth following its integration of BSI. The same is true for the French group Indosuez Wealth Management, after it took over the CIC group in Hong Kong and Singapore last year.

Experts agree the consolidation will continue, as regulation in Asia becomes ever more comparable with that in Europe, and the local competitors die (DBS, OCBC, Hang Seng Bank) grow in strength.

5. Advantages for local

The nationality of advisors cannot be determined from the data, but it is almost certain that in Asia, especially Singapore, a sea-change in attitude is underway. Thus banks -under pressure from governments- are increasingly favouring local advisors.

Furthermore local client advisors have acquired sufficient experience to compete with their foreign counterparts. And of course they have the added advantage of speaking the local language and dialects, as well as being familiar with local customs, which in the case of dealing with the «nouveau riche» from China, Indonesia and Malaysia, is of paramount importance.