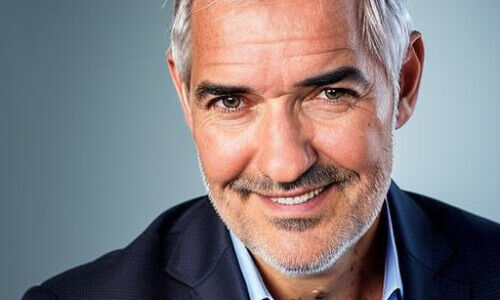

Investors in sustainable products have to take one thing in particular into account, says Roger Merz, manager of emerging market funds at Vontobel, in a finews.ch-TV-interview.

Socially responsible investing, sustainability investing or terms such as ESG (environmental, social, governance) are seeping into the financial world and are becoming more important than ever for investors. Sustainable investments have quickly developed into one of the fastest growing sectors in asset management.

Roger Merz, fund manager of an emerging market fund at Vontobel, is using the ESG criteria for making investment decisions. However he uses a fundamentally different weighting of the criteria.

«It would be more appropriate to turn ESG around and call it GSE,» says Merz in an interview with finews.ch-TV.

He and his team spend 50 percent of their time analyzing a company’s leadership, or governance. They examine whether the management board acts independently and whether Vontobel as a small shareholder is being treated fairly.

As far as the environmental criteria – the E in ESG – are concerned, most companies now apply minimal compliance standards, Merz explains.

In the finews.ch-TV interview, Merz also explains why Vontobel follows a bottom-up approach with the emerging market funds. And refutes critics who claim that some investments in emerging markets are high risk.