Executive salaries at the Wall Street banks have reached such stratospheric levels that salaries at Switzerland’s biggest banks look almost moderate by comparison. Here’s who tops the salary pyramid.

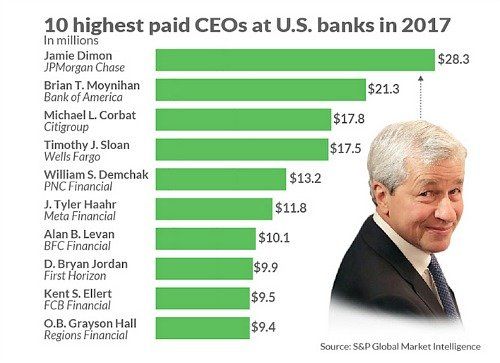

Following the resignation of Goldman Sachs’s Lloyd Blankfein, J.P. Morgan CEO Jamie Dimon (pictured below) takes over as the longest-serving Wall Street bank head. He was already the best paid CEO, earning some $28.3 million in 2017, according to industry portal «Marketwatch» (see table below).

Some distance behind was Brian Moynihan from Bank of America, and Michael Corbat, head of Citigroup. Compared with these incomes, the salaries of the two leading Swiss bank CEOs look positively modest by comparison. As finews.com has reported, UBS head Sergio Ermotti raked in around 14.2 million francs last year, making him the highest-paid chief executive among European banks.

The absolute salaries however need to be seen in the light of the banks' performances. So J.P. Morgan earned around $24.4 billion (24 billion francs) in 2017, and UBS 1.2 billion francs.

At UBS cross-city rival Credit Suisse, CEO Tidjane Thiam had to be satisfied with a slightly lower salary of 9.7 million francs in 2017. The drop in his pay package was driven by a trimming of his bonus, something forced through by shareholders.

Big Scandal

The scandal around fictitious accounts didn’t prevent Timothy Sloan, head of the retail bank Wells Fargo from pocketing $17.5 million. According to the «Marketwatch» report, this was the biggest issue in last year’s pay ranking.

The lower end of the pay scale also shows the widening of the gap between American and European bank pay. This increasingly enables U.S. banks to hire the best management talent. This, European banks have always insisted, is the justification for paying out some of their whopping bonuses. Those who don’t pay «market rates» stand to lose their best talents to the competition.