IMD professor Arturo Bris looks back ten years after the financial crisis. Improvements have been made, he writes for finews.com – not all of them favorable.

On September 7 ten years ago, the U.S. Treasury announced that the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation, popularly known as Fannie Mae and Freddie Mac, were place into conservatorship. In short, both institutions were unable to fulfill their obligations and were therefore technically in default.

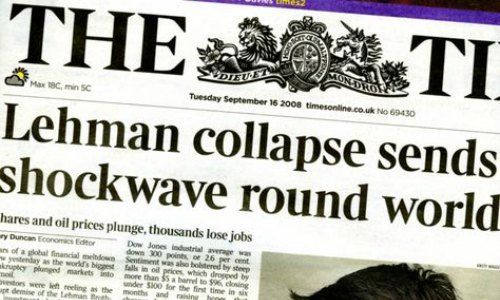

One week later, one of the largest and most successful investment banks in the world, Lehman Brothers, filed for bankruptcy in the Southern District Bankruptcy Court of New York.

It is now ten years since those events, which triggered the most profound financial and economic crisis ever. At the time I was a relatively experienced finance professor and had probably educated some of the culprits, and certainly many of the victims, of the crises that ensued.

Ten years later, our world has changed: investment banks do not exist in the form they used to; there is more, and better, regulation; the financial market landscape has changed dramatically, in terms of both players and behaviors; a few countries have defaulted. What have I learned during the last 10 years?

1. The next crisis will be different

My colleague the late Professor Stewart Hamilton used to say, even before 2008, that «I have seen too many crises in my life, and this will not be the last one.» In fact, crises happen, and we will have another one some day. However, crises do not repeat themselves and the next collapse will be different. Will it be caused by China? By geopolitical events? By increasing corporate leverage in some countries?

Because we all suffer from a confirmation bias, once the next crisis happen we will say that we saw it coming. But almost nobody, very few people, saw the Lehman Brothers collapse and its aftermath coming.

2. The 2008 crisis was a financial crisis, not a crisis of finance

Today, more than ever, executives need to know financial principles and master finance tools. In the last ten years, we have significant changes in the skill set of senior executives; in the curriculum of MBA programs, in the demand for leadership vs. functional training. We think that this is a mistake.

In 2008 it was people who failed, not the tools we use. It was the lack of knowledge by the leaders with respect to financial products and risk management that was lacking, not the power of finance theory to value securities and optimize portfolios.

- Page 1 of 3

- Next >>