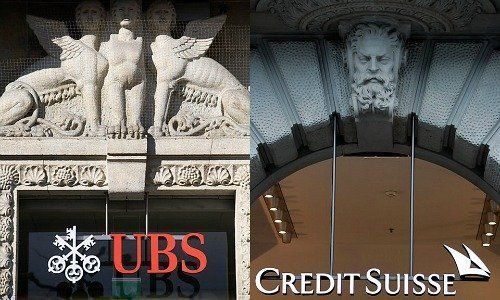

Credit Suisse's strategy got a cool reception from investors – which is reminiscent of UBS. Switzerland's two largest banks are becoming increasingly indistinguishable.

It was the (pre-)Christmas gift that elicited a shrug: Credit Suisse investors' first response to the Swiss bank's $1.51 billion-plus buyback was decidedly cool, as the stock drifted lower. Either the market had been primed for a more aggressive capital measure, or perhaps factored in a bolder strategic move from CEO Tidjane Thiam – or a bit of both.

Credit Suisse's measured and line of argumentation raise the comparison with Switzerland's largest bank, UBS. There, CEO Sergio Ermotti pledged higher payouts to shareholders and deeper costs cuts, but dampened expectations for growth. Since then, UBS' stock has eased by more than 7 percent – even as Ermotti splashed out on 13 million Swiss francs in shares.

Market Never Errs

To investors, the two cross-town rivals appear virtually the same. UBS has lost slightly less than one-third of its market value this year, and Credit Suisse substantially more than that. The larger bank trades just over book value, and Credit Suisse at approximately.

The market is always right, as both CEOs would agree. To be sure, both banks suffer under a wide rejection of European banking stocks and the generally tense atmosphere for equities at the moment. But the share price slide at UBS and Credit Suisse beg the question of whether both banks are compared as almost the same because they have grown increasingly similar in recent years.

Lightfooted vs Military Precision

- Page 1 of 2

- Next >>