The Crypto Finance Conference 2019 in St. Moritz has but its name in common with the event of last year, a visit by finews.com revealed. A warning shot was aimed at participants highlighting the big issue of regulation.

While the first Crypto Finance Conference (CFC) of 2018 was described as a meeting of high-rollers by finews.com, the second edition at venerable Suvretta House, which ends today, is much more down to earth.

Naturally, the occasional private jet did land at Engadin Airport and the babylonic blend of languages spoken reminds the visitors of how international the attendants were.

Spirit of Optimism Replacing Euphoria

The euphoria of organizers Marc P. Bernegger, Daniel Gutenberg and Eric Sarasin has been replaced by – let's put it positively – a sense of optimism. The crash of Bitcoin and most other cryptocurrencies is probably to blame for this tangible change of atmosphere.

Fittingly, the price of bitcoin et al. was not even discussed; it still was last year. And the term «cryptocurrency» has been replaced by «digital assets».

«Tokenized Economy»

Talk about a revolution and disruption of the institutionalized financial system with the help of the Blockchain technology is much less an issue today than the so-called «tokenized economy». With that crypto experts mean the conversion of tangible assets, companies and economic systems into digital and tradeable values enabling citizens to participate in the economy rather than to enrich themselves.

And still, the «we want to make the world a better place»-proponents kept a lower profile given the unresolved regulatory issues of this tokenized economy.

Regulation as a Power Tool

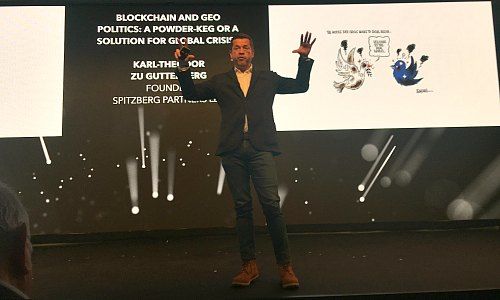

The dominating issue at this year's CFC was the regulation and the direction it should take (protection of property, security, best-practice standards and international harmonization), as well as the no-go areas for Blockchain regulation, ie the technology itself.

- Page 1 of 2

- Next >>