3. What About Latin America?

Julius Baer hasn't posted much good news out of Latin America since Beatriz Sanchez took over the market 13 months ago. An ex-private banker was convicted of money laundering, and client advisers have left the bank – both voluntary and pushed – and the bank has retreated from Peru, Panama, and Venezuela. This all as part of a «refocusing» of what Julius Baer wants to do in the region: Mexico, Brazil, and Argentina are now target markets. The problem is that Julius Baer has no presence in Argentina. Thus far, Sanchez has done a lot of retreating and no building – probably not the job the ex-Goldman Sachs banker signed up for.

4. Atlas – Bankers Collared

Julius Baer has been reviewing and reentering data on its clients since 2016. The so-called Atlas project was given more urgency with a Swiss enforcement probe of the bank. The suspicion is that Julius Baer didn't exercise enough caution when it accepted dicey clients, such as those with ties to Venezuelan oil firm PDVSA or soccer body FIFA. Hodler's central aim is to distance the bank from these missteps. In turn, pressure on private bankers is very high: some have complained about arriving at their desks in the early hours to work their way through the data before the client-facing work day begins.

5. Presidential Challenge

Ex-Credit Suisse executive Romeo Lacher has several challenges to tackle as soon as he takes the job in April: Julius Baer is in crisis, and Lacher needs to redefine its decade-long, possibly by making some unpleasant staff decisions. This is no small thing considering the bank's various vulnerabilities including the Latin American reorganization, the client review, and a major technology upgrade – not to mention the general lack of innovative ideas from the wealth industry currently. Lacher still wants to keep his day job as chairman of stock exchange operator Six, meaning he is firefighting on two fronts.

6. Julius Baer as Dealmaker?

Under previous CEO Boris Collardi, dealmaking was the «raison d'être». His successor Bernhard Hodler closed deals early in his tenure that Collardi had arranged. Since then, the 58-year-old has focused on cleaning up the unpleasant side effects from Julius Baer's hot growth streak instead. At current share prices, Julius Baer's stock doesn't offer up much firepower towards merger-and-acquisition projects anyway. If Julius Baer acquires, Argentina would be the logical choice: the South American nation is a core part of Julius Baer's strategy.

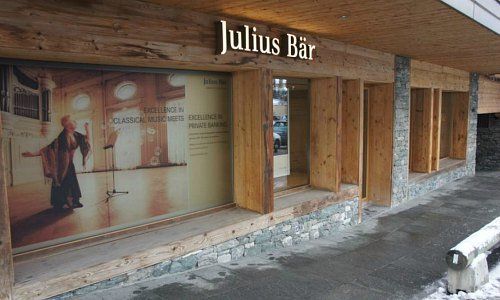

7. Passivity in Switzerland

Despite maintaining offices in 14 Swiss cities including from Kreuzlingen to Verbier (pictured), Julius Baer’s Swiss market share has languished at around 4 percent, according to bank insiders. Clearly, the private bank’s heavy focus on expanding into Asia, Latin America, and the Middle East stifled resources closer to home. Hodler has privately said he would like to slim down the Swiss branch network. More than two years after veteran private banker Gian Rossi took over the Swiss arm, Hodler could do with giving investors more clarity on progress and plans.

- << Back

- Page 2 of 2