The key to doing business with the super-rich is not the fanciest digital bells and whistles, according to Adrian Kuenzi, Union Bancaire Privée's new man in Zurich.

The march of digitization on finance is irreversible, with wealth managers in Switzerland spending millions to figure out how to capture a new generation of client through other means. At least one Swiss private bank is unimpressed.

«Technology isn't the decisive factor to win new clients in wealth management», Adrian Kuenzi, head of Union Bancaire Privée, or UBP, said recently at an event sponsored by «Finanz und Wirtschaft» in Zurich.

The private banker joined UBP last March, after stepping down as CEO of Notenstein following that wealth manager's acquisition by Vontobel. Previously, Kuenzi was a partner at now-defunct private bank Wegelin.

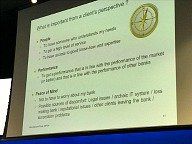

Peace of Mind

The 46-year-old argued that technological advancements are important for banking, but other things are more important in order to satisfy clients.

Besides competent staff (people) and performance competitive to rivals, Kuenzi said peace of mind is the decisive factor in wealth management.

Besides competent staff (people) and performance competitive to rivals, Kuenzi said peace of mind is the decisive factor in wealth management.

«Clients don't want to worry about their bank», he noted in reference to the roster of risks facing firms including losses, court cases, outdated IT, reputational issues, withdrawals, and succession issues.

«Don't Lose Sleep»

«A bank has to invest based on these premises», Kuenzi emphasized, meaning in qualified employees as well as investment expertise. Most of all, «invest in technology so that clients aren't losing any sleep when they think about their bank.»

The Geneva-based wealth manager employs roughly 1,800 and manages roughly 130 billion Swiss francs ($129.9 billion) in assets. UBP has roughly 200 staff in Zurich managing roughly 25 billion francs.