With the sheer size of the Olympic Winter Games Beijing 2022, it is only a matter of time until Chinese will spend their ski vacation in Europe, Beat Wittmann tells finews.com in an interview.

Beat Wittmann, you spent a week in Beijing and Chongli, the ambitious site of the 2022 Olympic Winter Games in Beijing 2022. What are your key takeaways?

My efforts to get a grip on the unprecedented boost in popularity and growth in winter sports in China has a personal dimension as I spent my youth in a Swiss mountain resort, my first job was as a ski instructor and have been a passionate skier ever since. So for me it was a special pleasure indeed to see this Chinese initiative in connection to the often-challenged winter sports industry.

My personal conclusion is that the grand plan which China has with the Olympic Winter Games 2022 is very much on track in all dimensions. It will be a big global boost for winter sports.

What's the impact of the 2022 Olympics for China?

Winter sports is part of a fast-growing sports tourism ecosystem driven by policy support. The 2022 Olympics will promote ski culture extensively, and push for respective infrastructure improvement. The rising middle- and upper-income population is upgrading their consumption and shifting towards a more natural and outdoor lifestyle.

From a sectoral perspective, winter sports can be split along the following categories: public infrastructure, like construction, transportation, communication, healthcare; hospitality such as hotels and restaurants; personal equipment like apparel, hardware, accessories; skiing site equipment – snow machines, cableway, snowmobiles– and resort operation as well as skiing service like training, equipment rental, insurance.

As a result, it is a highly attractive business from a global and financial perspective, with corporate advisory and investment opportunities available. However, only for those who act decisively, consistently and in a timely manner.

How has China's skiing industry developed over the years?

France's Club Med opened at Yabuli in 1995, and the skiing industry is now entering a fast-growing, transformational phase. With the 2022 Olympics, the relatively high number of small resorts will be replaced by full service and large scale resorts.

The growth rate of spending in personal equipment is generally expected to beat all other categories by a vast margin, and the related business opportunities go mainly to international lifestyle and sports brands, which have a dominant market position.

Broadly speaking the overall economic value creation of the ski market in China can be broken down in percent of total volume into following categories: personal equipment (15 percent), skiing site facilities (10 percent), resort operations (25 percent) and skiing services, hospitality and games (50 percent). So in quite some ways, this is the next chapter in the longtime love affair of the Chinese consumer with European luxury brands in particular.

What are the key drivers in this development?

Success factors in the luxury and lifestyle sector include the brand and the digital experience. Brand credibility, positioning, and development remain the «conditio sine qua non» for sustainable business success, encompassing authenticity, design, production expertise, and durable innovation. Digitalization is a clear and present challenge, however also a secular opportunity.

Could you elaborate on digitization in winter sports?

Mobile is always the fast-growing center of gravity and is being used by consumers to search, compare, select, and purchase. International winter sports brands and retailers have taken various localized and customer-centric approaches to tap the very large and fast-growing consumer market in China.

International brands’ strategy in China has been either to partner with domestic retailers such as B.C. Sports with Head, Lowa, Lasse Kjus, and Anta with Descente and international retailers such as Amer Sports – Salomon, Atomic, Arc’terix – or to open up a direct presence, like Bogner, Moncler have done.

What’s your impression of Chongli?

From a geographic dimension, most resorts in China are located in three major areas including the Northeast (Songhua Resort), Beijing area (Nanshan Resort) and Chongli, as China’s future biggest winter resort.

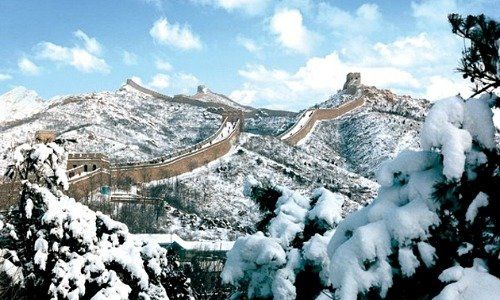

Chongli (pictured below) is being built to serve as the key 2022 Olympic winter site and destined as a major full-service winter and summer excursion and vacation destination. Public infrastructure includes a planned high-speed train link from Beijing to Chongli, which goes 250 kilometers in 45 minutes; a planned additional express highway which takes roughly two hours; a hospital; state-of-the-art communication network with a full 5G network rollout planned within two years.

Private infrastructure includes a range of five-, four- and three-star hotels, restaurants and entertainment, retailing space, residential property, and various sports training facilities. China certainly has the most potential to catch-up in all areas of hospitality and services of winter sports. Correspondingly there are attractive entry points for successful and experienced foreign operators from Europe, Japan, and North America.

While the 2022 Olympics will boost winters sports in China, will Europe and Switzerland benefit?

With the sheer size and future development of the ski market in China, it is only a matter of time until higher-end clients will spend more vacation in the prestigious overseas ski resorts in Europe and Switzerland. The globally known overseas resorts which combine smooth travel access and modern local infrastructure with uniquely beautiful landscape and nature and superior ambiance and hospitality will be in respective pole positions to benefit from China’s steadily emerging demand trend.

International ski resorts have chosen various avenues to gain experience and exposure to the Chinese market. Active engagement was chosen by Swiss resort Laax, which is not only co-branding like quite a few others do, but which will open a «Freestyle Academy» in Chongli at Genting Resort in 2020.

Beat Wittmann is chairman and partner of Zurich-based financial advisory firm Porta Advisors. His more than 30-year career in Swiss banking includes stints at both UBS and Credit Suisse as well as Clariden Leu and Julius Baer.