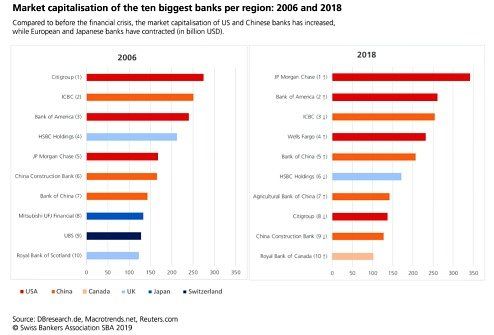

The numbers speak for themselves. Since 2006, U.S. and Chinese banks have grown substantially and European banks have contracted considerably. Why is this and is it a problem?

Martin Hess, Chief Economist at the Swiss Bankers Association

Martin Hess, Chief Economist at the Swiss Bankers Association

The world is unfair. Although politicians called for a massive reduction in the size of Swiss banks in the wake of the financial crisis, their reduced size is now viewed more critically. There was even a recent mention in the press of the Marignano of Swiss banks. The fact that certain European banks have contracted to an even greater extent is of little comfort. Against the backdrop of the too-big-to-fail efforts, it seems questionable that capitalization – above all of U.S. banks – has increased to an extent that belies the financial crisis. The Chinese banks also saw strong growth during the economic upturn that was in part financed by incurring significant debt (see figure below).

Successful Crisis Management in the U.S.

One of the main reasons for the growing disparity between Europe and the U.S. is the rapid and radical restructuring of the U.S. banks’ balance sheets that took place with support from the government. The consolidation in the industry led to ever larger institutions. Big banks with an international reach have the ability to diversify their financing risks more easily and enter into profitable business dealings accordingly. They are competitive and can accumulate capital.

While the Americans got to work, the Europeans spent a long time clarifying who was responsible for what. During the recession that followed, they lacked the strength and determination to undertake painful interventions and decouple financial institutions from the state. The prolonged period of low interest rates then took effect, meaning the European banks, which are rooted in the interest-rate business, did not have the fertile ground they needed in order to recover.

EU Banking Union in a Holding Pattern

A number of European banks are still in bad shape. This is likely the primary reason for the standstill in the establishment of the EU banking union. The banking union is to serve as the centralized supervisory body and resolve banks in the event of illiquidity. However, a union that starts out with fragile banks cannot be considered a trustworthy project. On the other hand, the exclusion of distressed banks would stigmatize these institutions and subject them to even greater pressure.

Despite this dilemma, it is clear that there can be no big pan-European banks without an EU banking union. And that is exactly the type of bank needed to address the increased competition both from overseas and from tech companies.

Market Fragmentation an Obstacle

Without the banking union, the financial system remains one in which states protect their taxpayers by ring-fencing, but in doing so, also encourage fragmentation. Global banks can no longer put their capital where it can be used most productively.

Moreover, they are not increasing their stability by spreading risk, but by reducing it, a fact that resulted in a credit crunch in many countries after the financial crisis.

Dependence on Foreign Countries a Risk for Industry

Without domestic big banks that offer investment banking services, access to international capital markets depends entirely on other countries. Larger companies increasingly rely on a small number of U.S. banks for new capital, mergers and other important intermediation services. This represents an economic risk.

On the one hand, market concentration in investment banking can result in oligopolistic behavior. On the other hand, global lenders usually retreat to their home market in a crisis. Without domestic providers that can step in as alternative lenders to U.S. banks, the domestic economy is exposed to a financing risk.

Switzerland Is a Step Further

The big Swiss banks have also contracted and repositioned themselves. However, they are well capitalized and meet the TBTF requirements. Controlled growth ensures they fulfill their universal role in international business. In doing so, they make an important contribution to the domestic economy and to the international reach of the Swiss financial center.

Because one thing is clear: without banks that operate globally, Switzerland cannot be a global financial center. And this means fewer jobs and less ability to set the agenda.

- Further information on this topic can be found in the SBA’s discussion paper.