Digital expertise is essential for the banker of tomorrow – but not the core quality of a private banker, a study compiled by Credit Suisse shows.

The bank client of the future expects to reach his personal contact through a wide range of channels – and preferably via a digital means.

The new banks such as Revolut or N26 have been built around the promise to satisfy this core demand of retail banking. The future owners of the most influential family businesses however have altogether different needs.

The future rich of this world expect what are perhaps better termed traditional qualities of relationship managers, a study compiled by Credit Suisse and the Young Investors Organization showed.

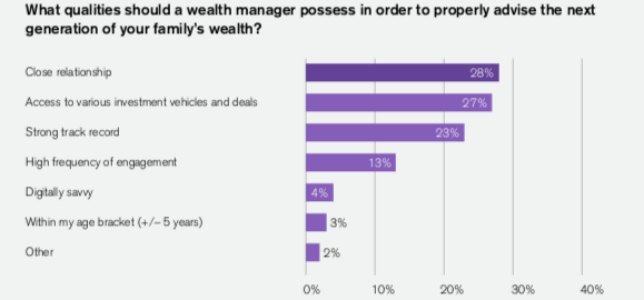

A close relationship with their bankers is the top priority of the influential people of tomorrow, the survey showed. The sample included 200 people and 28 percent of the surveyed named this quality as their No. 1 priority.

Only 4 percent opted for «digitally savvy», while a strong track record and access to investment vehicles both gathered about a quarter of the votes.

It's About More Than Just Money

The top investors of the future expect more than a sound understanding of the business and access to investment products however: They also demand non-financial support from their private bankers. This may include services such as the organization of a mooring slot for their personal yacht or help with getting a house maid.