Jobs that were created for compliance reasons will likely begin to disappear over the coming ten-year period. And one segment will be hard hit.

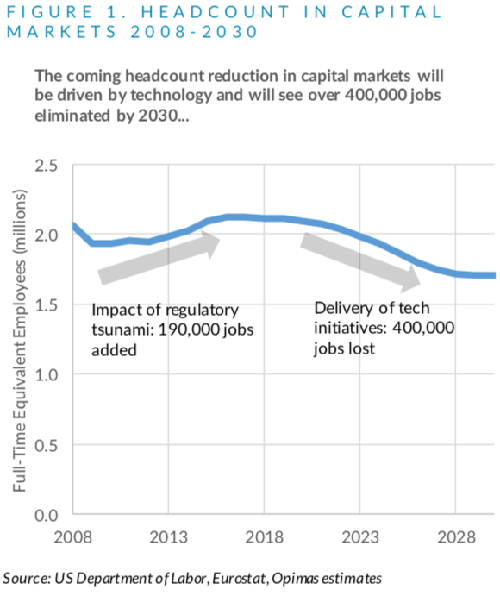

Tough times for banking staff: the finance industry will shed more than 400,000 jobs over a ten-year period as companies use new tools derived from artificial intelligence to digitize more and more tasks.

The last couple of years were much more positive for employment in the industry than the coming years, according to a study published by consultant firm Opimas (see picture below).

Following the financial crisis, almost all companies had to develop or reinforce compliance, with the effect that some 190,000 jobs were created across the globe (see below).

These jobs are quickly becoming tasks performed by computers, which means that banks can reduce their headcount. That’s also why the industry will still create more job opportunities for tech jobs, including big data, programming and code applications.

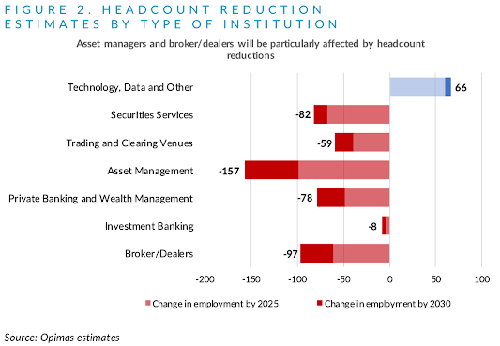

Asset Management Wipe-Out

The cuts will hit asset management hardest. Banks will more and more focus on quantitative investment strategies, based on artificial intelligence, machine learning and not on traditional analysis.

The asset management headcount will suffer from an outsourcing of trading desks.