Swiss private banks improved their profitability last year. A study shows which private bank had the best return and how the industry could improve its performance.

An employee of a Swiss private bank on average generated a profit of 70,000 Swiss francs ($71,000) last year, which is 3,000 francs less than in 2017. And still, the overall cost-income-ratio improved to 81.7 percent from 82.3 percent a year earlier.

These are figures taken from a study by IFBC, a Zurich-based consultancy, which specializes in the implementation of corporate finance plans. IFBC also included a ranking of the most efficient private banks (see table below).

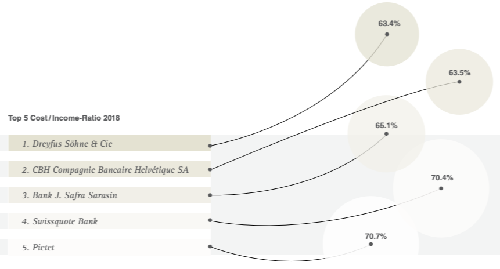

The champion among Swiss private banks in terms of efficiency is Dreyfus Soehne from Basel. It had a cost-income-ratio of 63.4 percent. J. Safra Sarasin, which had topped the table a year ago, dropped to third place on 65.1 percent. Geneva’s CBH Compagnie Bancaire Helvétique placed second.

Swissquote and Geneva’s Pictet follow in fourth and fifth place. Liechtensteinische Landesbank and Julius Baer are not among the top five.

Pay Increase for the Private Bankers

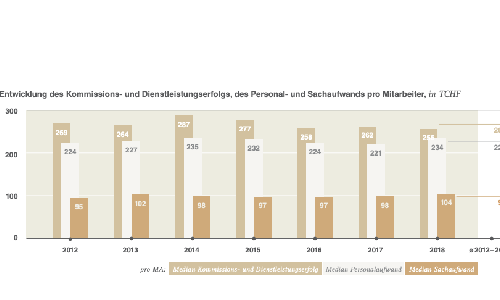

The study also presented information about the staff of Swiss private banks. The bankers on average generated less income and still earned more: the average cost of a Swiss private banker was 234,000 francs, up 13,000 from a year ago (see table below).

The big private banks tend to pay higher salaries – with an average of 265,000 francs – while the medium-sized firms (214,000) and small banks (215,000) paying considerably less.

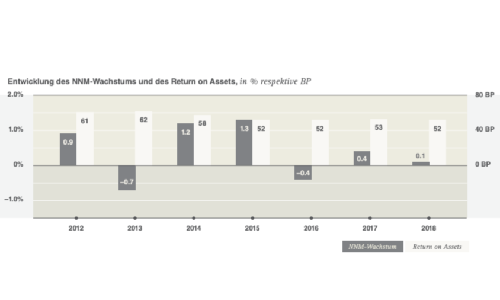

The growth rate of net new money slowed last year. The net increase at private banks was 0.1 percent in 2018, down from 0.3 percent in 2017.

The return on assets also fell, down one basis point to 52 points (see table below). Private banks earned 52 centimes on every franc in assets under management.