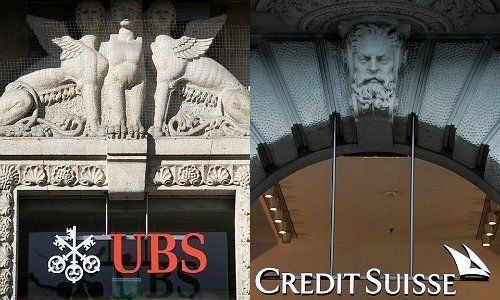

Ahead of UBS' and Credit Suisse's results, finews.com whether the Swiss wealth giants' focus on the super-rich will pay off – and when shareholders will put pressure on UBS boss Sergio Ermotti.

The second-quarter headwinds in capital markets and trading can be interpreted as confirmation of the wealth strategy embraced by both UBS and Credit Suisse. With their focus on banking the super-rich, the two Swiss giants are poised to weather the Wall Street storm.

The success of their strategies comes with some questions – especially in view of their share price and valuation. UBS, proud of its strong standing with the world's billionaires, has this year delivered a stock performance which investors find tough to stomach. UBS reports the quarter on Tuesday, Credit Suisse on July 31.

Chronically Feeble

Prominent analysts have already raised the specter of a strategy overhaul to revive UBS' fortunes. The Swiss bank's stock has sagged more than 1 percent so far this year – an underperformer in the wider European banking index (the picture is similar on a longer-term view).

CEO Sergio Ermotti is trying to kickstart the unit with measures like cost cuts, a tie-up with Japan's Sumitomo Mitsui Trust Bank , or founding an investment banking division aimed at the super-wealthy. However, the wealth mega-division can't shake the impression of being a bulky and inefficient asset supertanker.

Passive Clients – No Change

Falling revenue is an sign that clients aren't active – and will remain so. Industry observers point to UBS increasingly becoming an asset servicer rather than an wealth manager. In other words: clients park their funds with the Swiss giant, but buy products and services – if they are doing so at all – elsewhere.

An especially irritating point for CEO Ermotti: the performance of crosstown rival Credit Suisse's stock is not only much better year-to-date, but also in a longer view of the last 18 months.

No Resting on Laurels

Will the pressure rise on the long-standing UBS CEO? Shareholders already denied Ermotti, his 12-person management team, and UBS' board a key approval in May. The rejection was over UBS' money laundering troubles in France, but investors could eventually also target Ermotti, closing out his eighth year at the helm in their criticism and demand new leadership.

- Page 1 of 2

- Next >>