Switzerland's private banks are vanishing, but few have the gumption or ideas to reinvent themselves. The industry could be made up of less than two dozen, according to a provocative thesis.

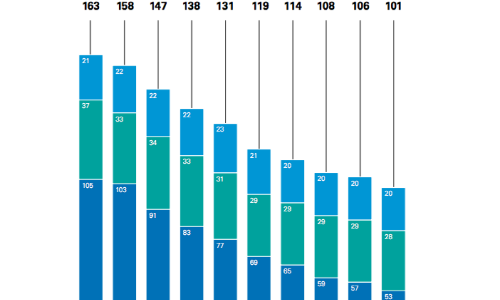

The alpine nation is home to 101 private banks, from 163 in 2010 – and those which have survived are on the sick-bed, according to a study by KPMG. Wealth managers aren't managing to trim the fat accumulated during the bull years: they are losing market share as less money flows into Switzerland.

The years-long slide leads KPMG's consultants to a stark conclusion: «Economically speaking, Switzerland doesn't need more than 20 private banks,» Philipp Rickert, one of two KPMG authors of the study, said. Rickert has been the firm's top auditor for banks and insurers in Switzerland since 2011.

«Who Would Cry?»

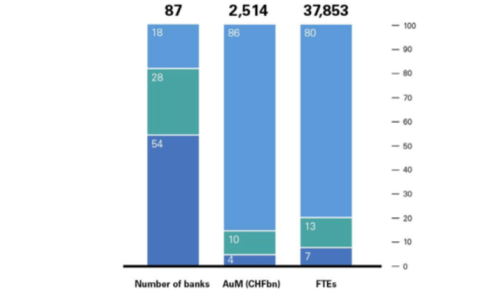

The segment of acutely imperiled, smaller wealth managers with less than $5 billion in client money fuels the radical view. The «minis» make for more than half of Switzerland's private banks in number. They are slower and less efficient than their powerhouse rivals – like UBS. For KMPG, the small boutiques appear to be a relic from a long-lost era.

«I don't know how many people would cry if they disappeared,» Christian Hintermann, the other partner, said of the more than 53 private banks which, tallied up, manage just 4 percent of total client assets. «Maybe the people who work there.»

The fact that 101 institutes remain is rooted in a belief that having a Swiss bank account serves another purpose than simply money management, Rickert said. Even after Switzerland gutted its iron-clad secrecy laws, the wealthy have sought stability and diversification through Swiss banks. The industry has nevertheless remained apathetic about its decline.

Tired CEOs

KPMG's consultants pinpoint one reason for the industry's hidebound ways: 40 percent of Swiss private banks are still run by the same CEO as in 2012. A fresh set of eyes is necessary in order to sensitive wealth managers to new technology which can help build a bridge to the next generation, and marshal strength for far fiercer competition than Switzerland is accustomed to.

Absent new ideas, the industry will continue its slide: half of private banks with less than $5 billion in client assets have disappeared in the last eight years, while the number of firms with more than $25 billion has held steady.

Scarcity of Ideas

Those best placed for the current environment – with some exceptions – $100 billion and over wealth managers. Boutiques with a clear niche in Switzerland as well as slim and efficient subsidiaries of foreign banks are also doing reasonably well, according to KMPG.

Now, it is up to a new generation of private bank CEOs to deliver ideas on how to rejuvenate banks in the most rapidly-decaying group. To be sure, specific suggestions are rare – even from the glut of consultants which are demanding something new.