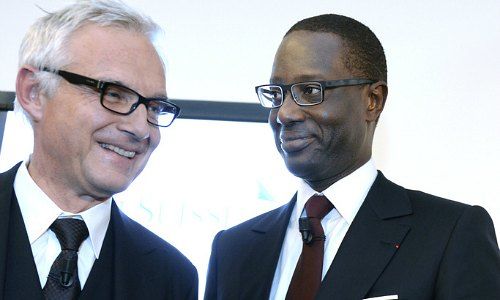

The chairman faces questions from a «strong» shareholder base, the person said, which includes U.S. asset manager Blackrock as well as Norwegian sovereign wealth fund Norges. After eight years presiding Credit Suisse, it turns out that Rohner's legacy will be how cleanly he can handle a farcical Keystone Cops-style episode on Paradeplatz.

Chairman's Legacy

Rohner hits the Swiss bank's statute of limitations in 2021 (extensions can be granted). He is very aware of the fact that his actions in coming weeks and months are «enormously important in how his tenure will be judged,» the person familiar with his thinking said.

Thiam's exit would, of course, raise the question of who replaces him. In Credit Suisse top management, Swiss boss Thomas Gottstein and risk overseer Lara Warner are viewed as the most promising candidates – Warner's weakness is that she hasn't overseen an operating business during her tenure in Credit Suisse's C-suite.

Seeking: Banker with Integrity

What Rohner is missing is a person of integrity, completely untainted by the affair, who can calm alarmed employees as well as represent Credit Suisse well to investors and the public. Eric Varvel, a top executive under CEO Dougan and currently head of asset management, has the qualifications.

The 56-year-old joined Credit Suisse nearly 30 years ago; his career spans a six-year stint in top management as co-head of investment banking, and he has also overseen the bank's activities in Asia as well as in Europe, the Middle East, and Africa. It isn't clear whether Varvel figures in Rohner's thinking.

- << Back

- Page 2 of 2