Julius Baer's new boss is eyeing a raft of measures in a strategy review. The Swiss bank’s independent, powerful private bankers are in for shock treatment as a result, finews.com has learned.

Nine weeks into his new job running the 412 billion Swiss francs ($417 million) private bank, Philipp Rickenbacher (pictured below) is counting down to January 2020. That’s when Julius Baer retreats to for an annual strategy conference.

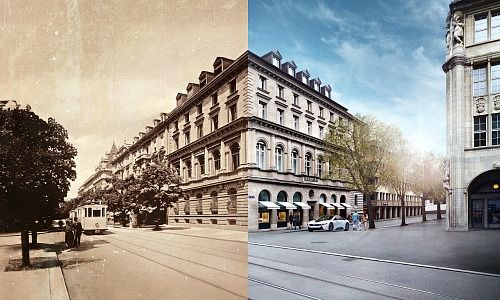

Private banking watchers have been quick to dismiss the little-known CEO as a «more of the same»-style executive. But Rickenbacher, who won the job with a promise of disruption for the 129-year-old wealth manager, is tackling the holy grail, according to three people familiar with his plans: corralling Julius Baer’s notoriously strong-willed private bankers.

Hugely Influential «Front»

«The private bankers, especially the ones who have been with Julius Baer for a long time, are probably not going to like it,» one person familiar with Rickenbacher's plans said to finews.com. The 1,490-strong «front» is hugely influential, and have resisted interference. Wooing them is the key to executive longevity: the group has been known to eject executives who try to curb their influence.

But with its gross margin on the decline, Rickenbacher is determined that nothing is sacred. «It’s about lessening Julius Baer’s reliance on its private bankers – it’s very delicate,» one person familiar with the plans says.

«This Is My Client»

A former McKinseyite, Rickenbacher is enlisting the U.S.-based consulting firm for his first strategy oeuvre, according to two of the people. It puts guardrails on the vast autonomy and privacy Julius Baer’s bankers private enjoy.

For example, Julius Baer bankers shield their clients fiercely («this is my client,» is a common refrain), but McKinsey and Rickenbacher are mapping out ways to make them share resources more effectively, as is commonplace at heavyweights UBS and Credit Suisse, one of the people said. Ringfencing «mini»-teams won’t wash, one person said.

Smaller Offices Too Costly?

He will also abandon activities that are persistently unprofitable, one of the people said, without specifying. The bank has long debated whether smaller offices such as Cairo, Beirut, and Johannesburg are too costly to keep (it sold its Amsterdam-based Dutch business last year).

Under Rickenbacher, an «ideas» banker who isn’t afraid to be unpopular as finews.com reported two months ago, Julius Baer is more radically tackling issues it in the past deferred.

- Page 1 of 2

- Next >>