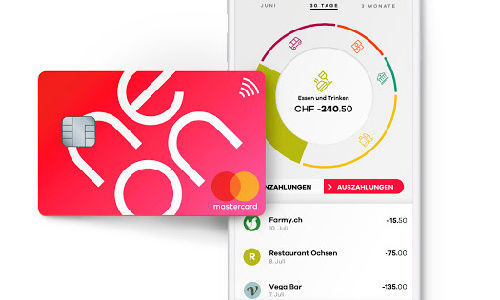

Neon, the Zurich-based banking fintech, will scrap the fee it charges for using its cards abroad. This will increase the pressure on conventional banks to adjust their fee structures.

Neon, the banking application, will drop extra fees charged on transactions abroad and a series of other charges as well, it said in a statement on Monday.

It will instead apply the cheaper Mastercard reference rate for transactions in foreign currency.

This will bring the fee policy in line with neo-banks such as Revolut and N26, which both are also operating in Switzerland. Revolut is applying the interbanking rate – without an extra margin – and N26 also uses the Mastercard reference rate.

Highflying Ambition

User data of Neon clients are still kept in Switzerland and the deposit insurance (up to 100,000 francs) is guaranteed for its clients through Hypothekarbank Lenzburg. Neon aspires to have the biggest number of users in Switzerland of any smartphone-based account provider.

In October, Neon had a total of about 10,000 clients in Switzerland. N26 was estimated to have the double of that number, while Revolut proclaimed to manage some 250,000 accounts.

Keeping Costs Minimal

Neon also took a dig at conventional banking in its statement, saying that none of the 20 staff at the company received a bonus of 14.1 million francs (UBS CEO Sergio Ermotti’s total compensation in 2018 was 14.1 million francs). Neon also said that while in the past high fees had been reasonable given that transactions abroad generated a lot of work for banks, digitization had rendered them obsolete: «We have decided to pass this on to you,» the bank said. «Of course, this is also easier for us, because we only have one core business, the private account. And we are only digital.»

Thanks to the very small number of people employed by Neon, it has been able to restrict its infrastructure to two offices, keeping operating costs minimal.