Switzerland’s biggest bank has lowered its growth targets yet again. It abandoned specific goals, while sticking to the growth ambitions for its most important division.

UBS was fairly upbeat in its outlook in the presentation of the 2019 results: as central banks are set to keep borrowing costs ultra-low, clients become more active in allocating assets. As their level of wealth is growing, so are fees generated by the bank.

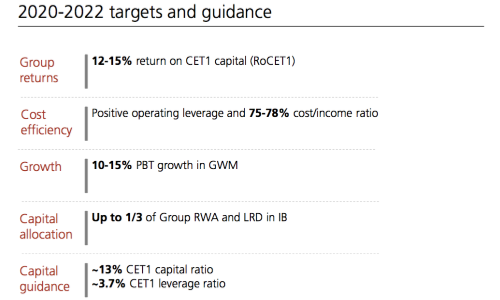

This sense of optimism didn’t quite make it into the goals set for the bank through 2022 (see table below). UBS lowered the old set of targets published in 2018, even though those hadn’t been overly ambitious.

Buried Expectations

The company with CEO Sergio Ermotti at the helm seems to have buried the hope to generate more than a 15 percent return on capital (CET1). The bank aims to make 12 to 15 percent instead of the earlier target of 17 percent in 2021. UBS also revised the cost-efficiency ratio – targeting positive operating leverage and a 75 to 78 percent cost-income ratio.

And still: «We are reaffirming our growth ambitions in GWM and a strong return on CET1 capital,» said Ermotti, according to the release.

Easing on Costs

Indeed, the targets for global wealth management have been kept – the new leadership team of Iqbal Khan and Tom Naratil clearly retain their optimism. The division expects to increase pretax profit by 10 to 15 percent each year.

While the two division heads are set to generate more profit for the bank, they are also under less pressure with respect to operating costs. The efficiency target has been removed and also the goal to report 2 to 4 percent net new money growth in each year.

Credit-Suisse-Strategy

To be sure, the two executives remain under pressure, because wealth management is the top priority for UBS. The investment bank, which underwent an expensive restructuring in recent months, follows a close second. The bosses of the investment bank, however, have no official targets to meet.

Khan will try to follow the same strategy to reach his goals as he did at former employer Credit Suisse. Digitization, closer proximity to the client and more risk in loans helped him achieving the targets set by CEO Tidjane Thiam, one of a few managers to do so.