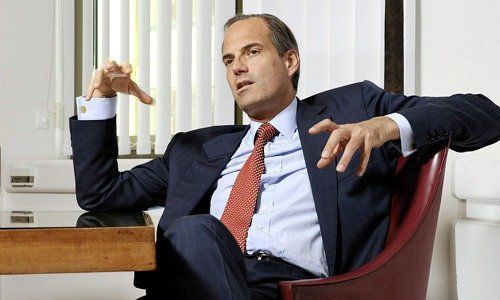

Swiss banker Eric Syz tells finews.com why he is rethinking asset management, including the sale of Syz's pan-European Oyster fund platform.

Eric Syz, why is Banque Syz selling its Oyster funds business?

Asset management is a cyclical business driven by market movements and sentiment. In the last few years, the industry registered outflow in European equities of more than $100 billion. Investors moved to cash and other assets.

Low-interest rates further weakened market performance. By joining forces with iM Global Partner we will reposition the pan-European Oyster fund distribution platform and offer it to a more global audience.

What are the terms of the agreement?

iMGP will acquire Syz Asset Management (Luxembourg), which is the Oyster Sicav’s management company. The two billion euros of assets under management will continue to be managed by Syz Asset Management. We can leverage Oyster’s footprint in markets such as France, Italy, Switzerland, Germany, and the U.K.

iMGP will also extend Oyster’s distribution in Latam, U.S. offshore and Asia, while the Syz Group will be able to offer a broader range of products and services to its private clients.

Philippe Couvrecelle, you founded iMGP six years ago, but it isn’t widely known.

The firm is a global multi-boutique platform focused on acquiring minority participations in several outstanding asset managers with the joint objective of accelerating their business growth supported by proprietary sales forces based in Europe and in the US. We employ 28 people and have offices in London Philadelphia and Paris.

How big is your business, and who are your shareholders?

We managed $11.7 billion by the end of 2019. Our strategic shareholders include Eurazeo, a European private equity investor, Amundi, one of the largest asset managers in Europe, and private shareholders Dassault/La Maison.

Why acquire Oyster funds instead of simply partnering?

Serving the wholesale and institutional clients of Oyster is mainly a distribution business where full ownership makes the most sense.

Eric Syz, does this transaction signify the end of your active asset management business?

No, the Syz group remains dedicated to creating innovative solutions. We underlined this with the creation of Syz Capital in 2018 which is at the forefront in the development of alternative and private market strategies. The group has over 1 billion francs of assets under management in alternatives. Furthermore, through a newly created subsidiary, we will continue to manage over 10 billion francs in institutional assets.