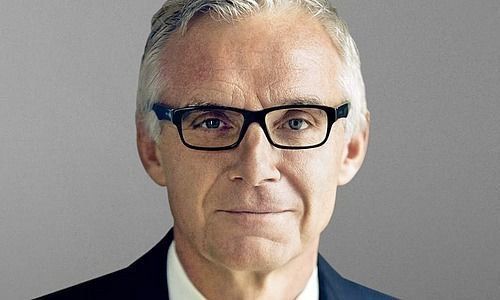

Urs Rohner reportedly sounded out investors about staying in the chairman's job at Credit Suisse longer his planned exit next year. This would circumvent not only term limits but also a quid-pro-quo over ex-CEO Tidjane Thiam.

The Swiss banker has approached weighty Credit Suisse investors in the last four months about remaining in the job past April 2021, according to the «Financial Times» (behind paywall), which cites several people familiar with the talks. Rohner said last month, after CEO Tidjane Thiam was ousted, that he would leave at next April's shareholder meeting.

Credit Suisse refuted the pink paper's reporting, saying Rohner «has never asked for an extension nor has he ever held preliminary discussions with investors on that subject». The bank has an «orderly succession plan in place» for him. His deputy, Roche boss Severin Schwan, said last month he wouldn't take the job.

Big Investor's Threat

Credit Suisse's denial will do little to calm frayed nerves: Rohner won a showdown with the bank's biggest shareholder, Harris Associates. The Chicago-based mutual fund had wanted Rohner out and Thiam to remain.

Rohner, a brilliant tactician and power player, will have totted up the support he marshalls – reportedly from other big investors like Blackrock, Norges, and the Olayan clan – against estimates of what Harris could commandeer. Harris executive David Herro told the «FT» he may renew a campaign to unseat the chairman for «disobeying» if Rohner elects to stay longer after all.